Annual Report 2022 III

The article is an abridged presentation of the findings of the study on the potential of nutraceutical products for export diversification, structural transformation and sustainable development of landlocked developing countries (LLDCs) financed in 2019-2022 by the CFC1 and implemented by UNCTAD. The findings of the study have been reported in the UN LDC V conference in Doha, Qatar, on 5 March 2023.

Introduction: The challenge of export diversification

There are several significant reasons why new markets for export diversification of landlocked and least developed countries remain an essential part of overcoming their commodity dependence and related vulnerabilities. Some of the best-known reasons to seek export diversification include the following:

1 Overdependence on a single market: Many landlocked and least developed countries rely heavily on a single market for their exports. If that market experiences a downturn or shifts its focus, these countries will suffer significant economic losses. Export diversification can help reduce this vulnerability and spread risk across multiple markets. According to the World Bank2, export diversification can lead to higher growth. Developing countries should diversify their exports since this can help them overcome export instability or the negative impact of terms of trade in primary products.

2 Increased competition: By diversifying their export markets, landlocked and least developed countries can increase competition and reduce the market power of dominant players. This can lead to better prices and terms of trade for these countries. Taking one example, Chile is the world’s biggest copper producer and its shipments of the metal meet around one-third of global demand and represent about half its goods exports. Yet Chile is also success story of a diversified economy, exporting more than 2,800 distinct products to more than 120 different countries.3

3 Access to new technologies and knowledge: Exporting to new markets can provide opportunities for landlocked and least developed countries to learn about new technologies and business practices, as well as to gain access to new sources of capital and investment. For example, technology and global integration can help countries move resources from low productivity to higher productivity and skill-intensive sectors, thereby setting development and economic catch-up into motion.4 It may be recalled here that one of the factors for this lack of structural transformation is LDCs’ overwhelming dependence on commodities for production and exports. According to the UNCTAD Commodities and Development Report 20215, over 75% of African LDCs depend on commodity production for over half of their export earnings.

When it comes to technological advancement and its effective use, the LDCs are at the lower end of the ladder. According to the World Intellectual Property Organization (WIPO)’s Global Innovation Index 2021, which monitors the state of technological advancement in 132 countries, 21 out of the 32 countries in the bottom quartile are LDCs. Initiatives gaining significance in this regard include those aimed at fostering meaningful connectivity and digital transformation in hardest-to-hit countries, including Least Developed Countries, Landlocked Developing Countries and Small Island Developing States.

4 Increased foreign exchange earnings: Export diversification can increase the amount of foreign exchange earnings for landlocked and least developed countries, which can in turn help reduce trade deficits and stabilize the economy. Commodity dependent developing countries must engage actively in global trade to take advantage of their natural endowment. At the same time, according to UNDP, economic openness explains the fact that an economy may be vulnerable to external economic shocks (as reflected by losses in export revenues and growth slowdowns), and the scale of impact depends largely on the degree of concentration of a country’s export portfolio.6 Thus diversification to new export markets is generally an essential measure to secure sustainability and resilience in commodity dependent developing countries. By spreading risk across multiple markets, these countries can better weather economic downturns and maintain stability.

5 Job creation: Diversification of exports can lead to the creation of new jobs in industries that may not have existed before in these countries. This can help reduce unemployment rates and provide new opportunities for economic growth. There is a general consensus that trade has high potential to foster inclusive growth and create employment. Classical trade theorists recommended active trade participation for both developed and developing countries based on comparative advantage.7 More recent theoretical and empirical studies have emphasized the importance of export diversification, rather than export specialisation or concentration. Key reasons for this paradigm shift include the likelihood that export diversification favourably influences the pattern of growth and structural transformation that countries and regions experience, coupled with the fact that diversification increases a country’s ability to meet objectives such as job creation and improvements in income distribution.8 Many developing countries have adopted export-oriented development strategies. Such development strategies have often been implemented through the establishment of labour-intensive, export-oriented manufacturing sectors over the last three decades.9

By opening up new markets, vulnerable countries can reduce their dependence on a single market and increase their resilience, competitiveness, and economic growth potential. Why is there a particular focus on landlocked least developed and lower-middle-income countries? This emphasis arises from their comparatively low levels of economic development and frail infrastructure. As a result, transaction expenses, particularly those associated with transportation and insurance, tend to be higher, thereby obstructing trade flows and diminishing export competitiveness.

The UNCTAD-CFC study underscores the important point of the need for identifying products that will enable LLDCs to diversify their exports and foster the process of structural transformation. Unfortunately, the only form of structural change that has taken place in LLDCs has been a shift from low-productivity agriculture to low-productivity and non-tradable services. Furthermore, despite the growing importance of services, their impact on exports has been minimal. For LLDCs, services exports account for only 11.5% of total exports.

According to UNCTAD, structural transformation does matter for sustainable development.10 Historically, successful economic growth has been associated with structural transformation, which is the creation of new areas of activities by shifting resources from traditional to modern sectors and from low-technology and low-productivity to high-technology and higher-productivity areas of production. In this context, structural change takes place not only across sectors – say from agriculture to manufacturing or services – but also by moving from low- to high-productivity activities and the production of new and preferably more advanced, sophisticated and competitive products within sectors.

For landlocked countries, it is especially important to produce goods that are easier to transport and get to markets to attain competitiveness, especially in international markets. One way to do this is to explore the potential for developing niche or unique products for export specialisation and shifting resources to the production and exporting of high-value and low-volume products. Some landlocked African countries have done this by encouraging investment in high-value products that are airlifted to high-income markets in Europe.

It is important to note that value-addition, productivity growth, and linkages could take place not only in manufacturing. Development is not an ‘either or’ option. Transformation and diversification can and does take place in agriculture and services, which are the two areas where landlocked countries need to give priority attention in the coming decades. By recognising one’s comparative advantages, biodiversity, and natural resource endowments in their totality, landlocked countries can identify specific products that they can develop and promote as export items.

The global economy is inextricably tied to the health and productivity of terrestrial, marine, and other aquatic ecosystems, and each country has the responsibility not only to protect its biodiversity but also to utilise its rich resources sensibly to maximise income and benefit its citizens in a sustainable manner. Nutraceuticals can be developed and exported competitively as specialised products that landlocked developing countries can produce.

Unutilised natural resources in developing countries are often closely linked to their unique natural endowment such as forests, wetlands, and wildlife facing threats from industrial human activities leading to deforestation, mining, and poaching. These activities not only cause environmental damage but also undermine the economic potential of these resources. However, if the economic value of these resources can be recognised and harnessed in a sustainable manner, it can create incentives for their conservation and protection, which can ultimately contribute to preserving biodiversity.

Another way to add economic value to natural resources is through sustainable resource extraction practices. For instance, harvesting non-timber forest products such as fruits, nuts, and medicinal plants in a sustainable manner can provide livelihoods for local communities while protecting the forest ecosystem. The development of economic value of nutraceuticals can contribute to protecting biodiversity in developing countries by creating economic incentives for their conservation and sustainable use. This can provide a win-win solution for both economic development and environmental protection.

UNCTAD report, resulting from CFC-UNCTAD project11, reviews nutraceutical products from certain landlocked developing countries and the constraints that they face in external markets.

The main objectives of the study

The primary aim of the study was to explore the opportunities for boosting nutraceutical exports from LLDCs and to identify potential market access barriers faced in key markets. As outlined below, the concept of nutraceuticals is somewhat vague.12 To address these concerns, the following section provides a definition and an overview of nutraceuticals, as well as their distinct characteristics as potential export products for LLDCs and other vulnerable commodity dependent developing countries.

This report resulting from the study focuses on several key topics:

• It offers examples of nutraceutical products that can be exported from LLDCs, but the examples aren’t exhaustive. Each country will need to conduct more research to identify all possible nutraceuticals available within its borders.

• The report mainly focuses on LLDCs, but many points also apply to LDCs, especially when it comes to market access. Some of the case studies involve landlocked LDCs such as Burkina Faso, Ethiopia, Bhutan, and Nepal. However, non-landlocked LDCs can also benefit from exporting nutraceutical products, including those derived from marine biodiversity.

• The case studies in the report cover landlocked countries from various developing regions, including one from Eastern Europe. Specifically, it looks at Ethiopia and Burkina Faso in Africa, Bhutan and Nepal in Asia, Bolivia in Latin America, and Azerbaijan in Eastern Europe. Each case study briefly discusses the country’s export structure, challenges for export diversification, and implications for nutraceutical exports.

• The report emphasizes production and market access constraints for nutraceutical exports from LLDCs, particularly regarding standards and quality control. It covers both supply and demand aspects, as well as the difference between market access and market entry. It highlights that meeting demand and securing market access doesn’t guarantee market entry, as major markets have strict standards that must be met.

• The in-depth analysis of standards and market constraints is useful for potential exporters and policymakers seeking to develop the necessary infrastructure, research, testing, and regulations to meet international standards.

• The report looks at market access barriers in areas with growing or potential demand for nutraceuticals, including the European Union (EU), the United States, Japan, China, Korea, and India. While these countries don’t represent the global market, they are major markets for nutraceuticals and account for a large portion of the world’s population.

• Many LLDCs and other vulnerable countries haven’t yet tapped into the potential of their natural resources for economic development. This report aims to encourage further research and exploration in this area.

Nutraceuticals: definition and special features

Nutraceuticals are products derived from food sources that offer additional health benefits beyond basic nutrition. They are designed to improve overall health, prevent disease, or support the proper functioning of the body. Nutraceuticals can be found in various forms, such as functional foods, beverages, and supplements.

To better understand what products could be regarded as nutraceuticals, let’s look at some examples that a reader might encounter in their daily life:

1 Functional Foods: These are everyday foods that contain ingredients with proven health benefits. Some common examples include:

• Probiotic yogurt: Yogurt with added live bacteria (probiotics) that can improve gut health and digestion.

• Fortified cereals: Breakfast cereals enriched with vitamins and minerals like iron, vitamin D, or calcium to help meet daily nutritional needs.

• Omega-3 enriched eggs: Eggs produced by hens fed with a diet high in omega-3 fatty acids, resulting in eggs with higher levels of these healthy fats, which can help improve heart health.

2 Health Beverages: Drinks that contain ingredients known for their health benefits. Examples include:

• Green tea: Rich in antioxidants called catechins, which can help protect cells from damage and reduce the risk of chronic diseases.

• Functional water: Water that has been enhanced with vitamins, minerals, or herbs to provide additional health benefits.

3 Food Supplements: These are concentrated sources of nutrients or other substances with a demonstrated health effect, usually taken in the form of capsules, tablets, or liquids. Examples include:

• Fish oil supplements: Containing omega-3 fatty acids, which can help reduce inflammation and improve heart health.

• Multivitamins: Containing a combination of vitamins and minerals to help ensure adequate nutrient intake.

• Herbal supplements: Derived from plants with potential health benefits, such as echinacea for immune support or ginseng for energy.

4 Natural whole foods: Certain fruits, vegetables, and grains are also considered nutraceuticals due to their inherent health benefits. Examples include:

• Blueberries: Rich in antioxidants and known for their potential benefits in improving memory and cognitive function.

• Spinach: High in vitamins, minerals, and antioxidants, which can help maintain a healthy immune system and reduce inflammation.

• Whole grains: Such as oats and quinoa, known for their high fibre content and potential benefits in managing blood sugar levels and promoting heart health.

These products can reach their customer in grocery stores, pharmacies, or health food shops, under the general marketing promise that incorporating them into daily diet can help improve overall health and well-being. It is neither ordinary food that people consume everyday nor officially recognised medicine. It falls in the middle and includes a wide range of plants and fruits that are traditionally and through modern research considered to have health-related benefits on humans. Essentially, therefore, any food product or derivative sold in a ‘health food’ store or found on the aisles of the ‘health food’ section of a supermarket, is claiming the status of nutraceutical.

Furthermore, despite the somewhat vague definition and often scientifically unproven benefits of health food and supplements, consumer demand is rising strongly in developed and developing countries such as China and India. This is exemplified by the rising demand for organic produce and products, despite higher prices than conventionally grown fruits, vegetables, grains, oils etc. For example, in 2016, purchases of organic foods in the United States rose 8.4% compared to 0.6% for all food products. Other examples include essential oils, for which demand is booming even despite controversies about their health benefits.

The nutraceutical market, which includes functional foods and dietary supplements, was worth around USD 382.5 billion in 2019. People all over the world, especially in the US, Europe, Asia Pacific, Latin America, and the Middle East, are increasingly interested in these products. The market was predicted to hit USD 412.7 billion in 2020. The US, Europe, and Japan make up more than 90% of the market, while India represents about 2%.

The growing demand for nutraceuticals can be attributed to factors such as increased income, heightened consumer awareness about health issues as the population ages, a stronger emphasis on prevention over cure, scepticism towards modern medicine’s invasive procedures and significant side effects, a deeper interest in and understanding of traditional remedies from other cultures, and concerns about environmental and social sustainability (particularly in the case of organic products). Additionally, there is a global trend shifting from meat to plant-based diets, with an increased focus on ethical food sourcing13.

All these information flows have created a booming market in health food and supplements and new opportunities for enterprises in developing countries to produce functional plant-based food products for export as nutraceuticals. In many cases, the ingredients in nutraceuticals have long been cultivated or found in the wild in developing countries. If LLDCs can become competitive producers and marketers of nutraceuticals, the effects could be considerable on incomes, employment and poverty reduction. Moreover, increased returns from growing traditional plants can contribute to preserving biodiversity and indigenous cultures.

In order to capitalise on the worldwide demand for nutraceuticals, it is crucial to comply with the stringent regulatory and quality requirements that prevail in developed countries. While it is true that nutraceuticals typically face less regulation than pharmaceuticals, adhering to these standards is still a demanding task for any product, particularly those aimed at discerning consumers who prioritise health effects.

Given the health-related implications of nutraceuticals, governments in developed markets persistently enforce and oversee strict regulations on standards. These rigorous requirements can pose significant obstacles for potential exporters hailing from developing countries. The report delves into these challenges, placing particular emphasis on the discussions surrounding these issues, in order to provide a comprehensive understanding of the barriers faced by nutraceutical exporters.

Exploring the potential that the biodiversity ecosystem offers: bioprospecting

Bioprospecting is the exploration of biodiversity for commercially valuable genetic resources and biochemicals. It involves gathering information from the biosphere on the molecular composition of species to develop new commercial products. These products may be pharmaceutical, agricultural, industrial, or chemical processed end-products derived from biological resources.

In the context of identifying new niche export products that could be marketed as nutraceuticals, bioprospecting can play a crucial role. By exploring a country’s diverse ecosystem and untapped reservoir of natural resources, bioprospecting can help discover unique properties of plants, fruits, animals, and microscopic organisms with potential nutraceutical properties. Developing countries can harness bioprospecting to boost economic development by tapping into their native biodiversity. Organizations like UNCTAD’s BioTrade14 Initiative can provide support to these countries in collecting information and transforming and commercialising goods and services derived from their native biodiversity.

Through bioprospecting, researchers identify novel compounds or genetic resources within a country’s ecosystem, which could be developed into nutraceutical products. These products could then be marketed internationally, providing an opportunity for developing countries to establish a niche export market based on their unique biodiversity. This process not only helps boost the economy but also promotes sustainable use and conservation of natural resources. The results of bioprospecting can lead to natural ways to grow crops, production of food supplements to improve health, and the treatment of chronic diseases. It can also create economic incentives for the conservation of biodiversity, serve as a foundation for modern biotechnology in the developing world, and provide local and indigenous communities with ways to benefit from their unique understanding of the environment in which they live. This is possible both in marine ecosystems and terrestrial ecosystems.

Bioprospecting in developing countries faces a number of challenges that limit their ability to effectively participate in the global biotechnology industry. One of the main challenges is the lack of scientific capacity to carry out the high calibre research required for patentable discoveries and the establishment of biotechnology companies. Many developing countries have a shortage of scientists and researchers with the expertise needed to carry out advanced stages of biological prospecting research. This results in a limited ability to effectively identify, collect, extract, and screen genetic resources.

To address this challenge, developing countries need to expand their facilities for collection, extraction, and screening of genetic resources, and demonstrate their capabilities to potential investors15. This would require significant investment in infrastructure and research facilities to enable the countries to compete in the global biotechnology industry. Developing countries should establish partnerships with research institutes, academic and domestic and foreign companies to strengthen their human capital, scientific and organisational resources for manufacturing, marketing, and the management of sustained research and development.

Another challenge that developing countries face is the limited bargaining power of producers of nutraceutical products. To strengthen their bargaining position, producers of nutraceutical products need to establish partnerships in sector-wide networks to increase productivity and trade. Such networking could also help to increase productivity and trade and has considerable economic importance. In addition, producers must adopt an array of standards and codes of conduct related to quality, safety, environmental and health concerns to be able to obtain market access.

Finally, developing countries must ensure that their bioprospecting activities are carried out in a sustainable and ethical manner. This requires effective regulation of bioprospecting activities to prevent over-exploitation of genetic resources and ensure that local communities benefit from the commercialisation of genetic resources. It is important for developing countries to strike a balance between the economic benefits of bioprospecting and the need to protect their natural resources and the rights of local communities.

Selected products with potential as nutraceuticals

The report examines the cases of nutraceutical products from landlocked countries, including Bhutan, Nepal, Burkina Faso, Ethiopia, Bolivia and Azerbaijan. The products covered in the full report include cardamon, red rice, citrus, ginger, sea buckthorn, shea, sesame, cashes, frankincense, teff, quinoa, amaranth, tropical fruits, hazelnuts, pomegranates, persimmons. Below is the summary of finding regarding some of these products.

Cardamon (cardamom)

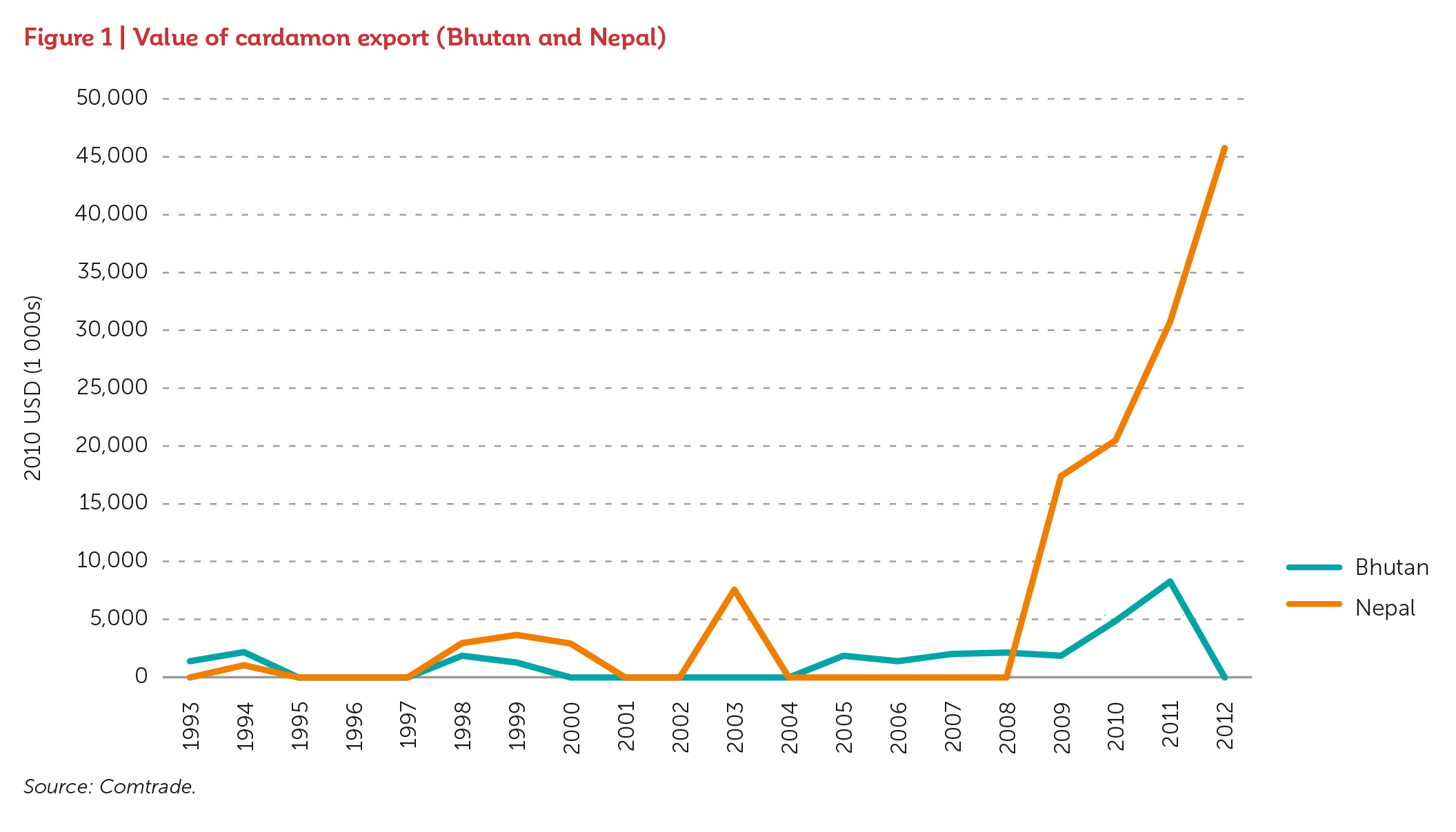

Cardamon, a spice with numerous health benefits and versatile applications, holds immense potential as a nutraceutical. The study considers the example of Bhutan where an increasing number of citrus farmers transitioned to cardamon cultivation, demonstrating that cardamon is becoming a viable alternative for under-producing citrus orchards. As one of the world’s most valuable spices, alongside saffron and vanilla, cardamon is a well-established cash crop in Bhutan16.

Although the large, black cardamon variety found in Bhutan is less valuable than its small, green counterpart, it is welladapted to the cold, steep-sloped conditions of the Himalayas. This makes it a particularly suitable crop for the region. Despite facing export challenges due to India’s Goods and Services Tax implementation, this obstacle has shed light on the weaknesses in Bhutan’s production that need to be addressed before targeting developed countries.

Cardamon’s labour-intensive nature primarily stems from the handpicking of pods from the perennial shrub, a member of the ginger family. Although small, green cardamon is more popular, the large cardamon cultivated in Nepal, India, Indonesia, and Bhutan has a unique flavour that contributes to its appeal. The extensive cultivation of large, black cardamon in Bhutan is indicative of the country’s favourable climate conditions for this crop.

Cardamon’s market potential as a nutraceutical is mainly based on its numerous health benefits, versatile uses, and high value.As the crop is well-adapted to the Himalayan climate and terrain, countries such as Bhutan have a unique opportunity to capitalise on this lucrative market. By addressing production weaknesses and embracing the unique qualities of the large black cardamon variety, there is substantial scope for growth and expansion in this market.

Cardamon has many health benefits. Pods are packed with antioxidants that help fight against inflammation. Cardamon is also known to relieve a variety of digestive issues, including discomfort, nausea, and vomiting. Some research suggests that consuming cardamon may even help heal ulcers. It is most known for its ability to freshen breath and prevent cavities17. Gargling cardamon can help fight against teeth and gum infections and throat discomfort. It has been known to reduce muscle spasms and improve respiratory ease and health. The vitamin C, potassium, and antioxidants in cardamon are said to lead to healthy skin and hair, which makes cardamon fitting for use in cosmetics as well.

Known for its use in masala due to its smoky flavour profile, cardamon is also used to flavour vegetables and is commonly found in mixed spice preparations. Cardamon can also be steeped as tea, though black cardamon is not sweet like its green counterpart18.

Black cardamon can also be found in coffee, which comprises a significant portion of global cardamon exports. Cardamon can even be taken as an herbal supplement or used in sweet bakery products19. Large cardamon is composed of 2–3 per cent oil, from which essential oil can be extracted through steam distillation, maintaining the beneficial properties of the cardamon. It can be inhaled as an aromatic or used in a variety of cosmetics.

Though uncommon on the market, the oil of the cardamon seeds can be used in lip balms, facial cleansers, hand soap, bodywash, and body lotion, as found in Pangea Organics product offerings20. Because cardamon is also known to freshen breath, it can be used in breath mints, gums, mouthwash, and toothpaste. Use in bath salts is another option for uses. There are many opportunities for large cardamon use in nutraceuticals, but producers should be aware of the more pungent odour and smoky quality of large cardamon.

The largest producer of cardamon is Nepal. As of 2017, producers from Nepal supplied 68 per cent of international demand for large cardamon, the main markets being the Middle East, South Asia, Southeast Asia, and Europe21. India’s Sikkim and Darjeeling districts were large producers of black cardamon until the crop was riddled with viral diseases. Old plantations, poor quality planting material, lack of irrigation, and poor canopy management were the largest contributors to India’s decline in production22. However, global warming was the greatest threat to India’s cardamon, as large cardamon grows under cooler, shaded conditions. Bhutan is the only other producer of large, black cardamon, but it has not yet matched the production of Nepal and India. However, as of 2017, Bhutanese cardamon sold for a higher price than Indian cardamon23. Although there are no public data on world price of large cardamon, prices since 2017 have been on a downward trend due to a drop in overseas demand, e.g. between 2014 and 2017, Bhutanese and Nepalis newspapers have reported that prices dropped 75 per cent.

Sesame

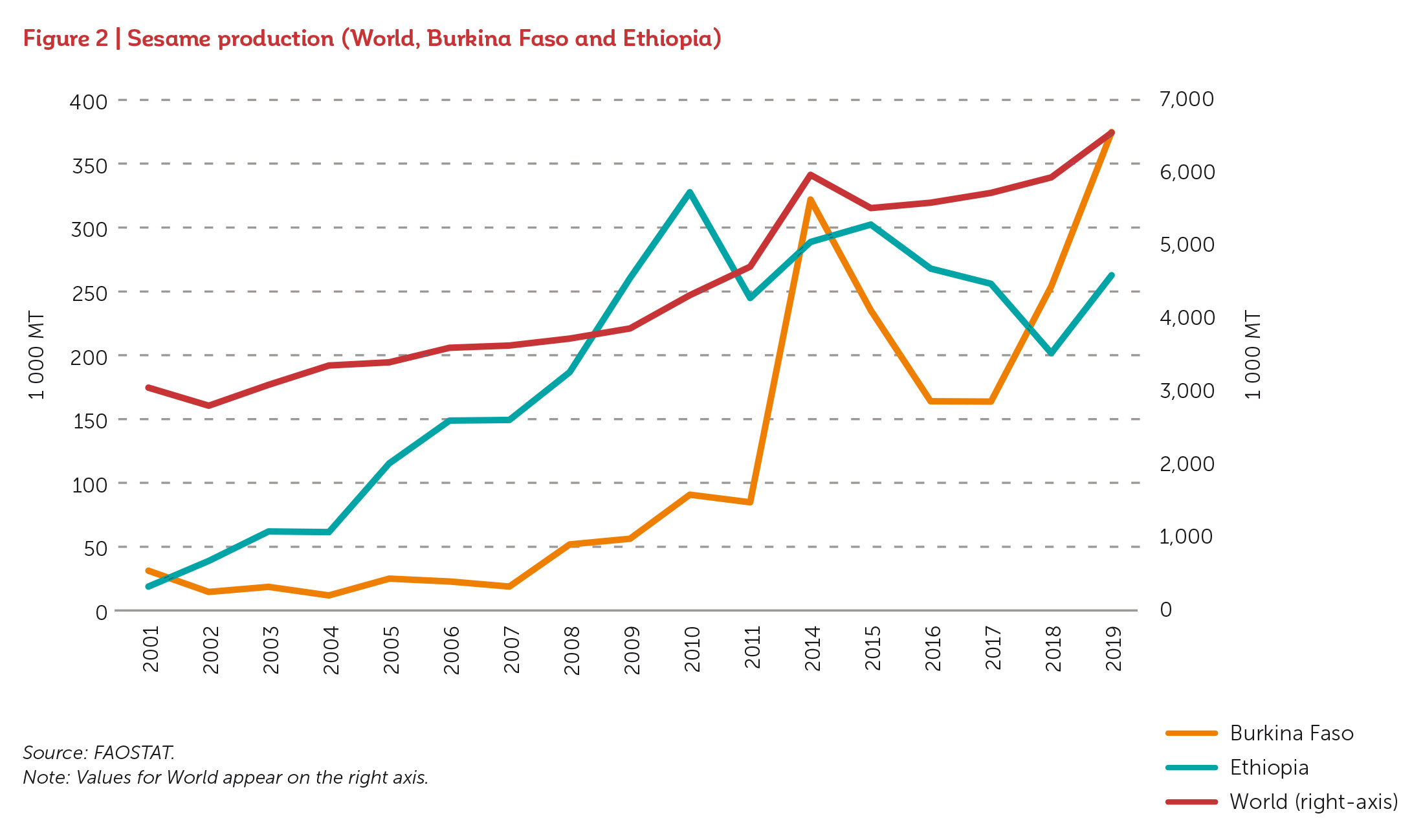

Sesame is an important emerging crop in many LLDCs, such as Burkina Faso and Ethiopia, boasting significant export potential, with exports having increased tenfold since 2000, largely driven by a high global demand. This crop is well-adapted to Burkina Faso’s semi-arid climate and has become the country’s secondlargest cash crop behind cotton. Sesame is low maintenance, requiring little horticultural support, and can thrive even without significant rainfall or fertiliser.

Sesame is known for its notable nutritional and health benefits. It contains the antioxidant gamma-tocopherol, protein, and dietary minerals. Studies have shown that it can slightly reduce blood pressure. Moreover, sesame oil, which is rich in skinbeneficial minerals and proteins that promote hair growth, has become a popular cosmetic product, particularly in Asia, and is gaining increasing popularity in the US. The cosmetic industry currently represents less than 10% of total demand but is the fastest-growing segment in the sesame oil market.

The sesame plant is a bush-like legume mainly grown in Southeast Asia, Central America, and sub-Saharan Africa. It grows as a small bush or upright tree, with pods that burst when ripe to release seeds. The crop varies in quality from high-value white sesame seeds to lower-value brown seeds. Despite its high potential yields, a significant portion of the global sesame output is lost due to ‘shattering’ – the scattering of seeds from unmonitored ripe pods. The sesame seed is commonly used in bread and other wheat-based goods in North America and Europe or processed into oil for flavouring in many Asian dishes. From a health perspective, sesame serves as an antioxidant, lowers cholesterol, and boosts immune response.

The greatest obstacle, at present, to developing downstream oil production is in fact the sheer profitability of crude sesame production. Crude sesame prices have risen to such an extent that selling raw seeds is nearly as profitable per unit as selling medium-quality oil, and consequently entrepreneurs have little price incentive to invest in oil production24. If prices stabilize, oil production may become a viable expansion sector, but under current conditions farmers can do well for themselves by simply selling crude sesame25.

Since 2005, international demand for sesame has consistently exceeded supply, leading to some key impacts on the value chain. Firstly, due to the high profitability of sesame exports, competition among exporters has largely erased the gap between global and farm-gate prices. In 2012, sesame producers in Burkina Faso received 75% of the country’s total sesame export revenue, significantly higher than the 23% that cotton producers received from the total cotton export revenue. Despite Burkina Faso exporting more cotton than sesame by global market value, the farm-gate value of the sesame sector surpassed that of the cotton sector. This implies that sesame cultivation could be a more viable option for farmers looking to expand into cash crops, suggesting that sesame may drive pro-poor growth more effectively than cotton or any other major export crop.

Secondly, the competition among exporters has led to a standard practice of immediate payment to sesame farmers at the farm-gate, and even pre-financing of harvests when prices are favourable. This practice helps farmers avoid poor harvests resulting from insufficient use of fertiliser or quality seeds. However, this puts pressure on exporters, who have to pay for an entire year’s supply during the 2–3-month harvest season, while their export revenues are spread throughout the year. Larger buyers placing advance orders can ease some of this burden, but often, exporters have to resort to commercial banks to bridge this financial gap. As many regional banks are unfamiliar with the sesame sector, exporters often have to use their capital assets as collateral or face high-interest rates, up to 20%. Therefore, providing market-rate loans to exporters, either by Burkina Faso’s government or private entities, could be a cost-efficient way to support the sector.

Some key recommendations regarding the development of sesame as a nutraceutical export include:

1 Enhance productivity by promoting increased use of fertilisers and high-quality seeds. This could involve extending fertiliser subsidies to sesame producers, creating a commercial fertiliser market, supporting private sector seed vendors, and encouraging seed-crossing partnerships with countries like Mali and Nigeria. Additionally, pilot extension services in underserved areas could significantly improve smallholder yields.

2 Improve marketing efficiency in regions with weaker connections to the marketing channels by expanding the warehouse network and implementing an extension programme targeting areas with lower levels of direct sales by producers. This would particularly benefit remote and hard-to-access regions.

3 Prioritise traceability using an electronic tracking system similar to that used in the coffee sector by the Ethiopian Commodity Exchange (ECX). Improved traceability could boost sales, promote ethical sourcing, and potentially result in better sorting and pricing of sesame seeds.

4 Establish official financing channels for sesame exporters, through public-private partnerships including those with NGOs. This would help relay global demand to producers and stimulate necessary investment in seeds, fertiliser, and equipment.

5 Strengthen ties with Asian buyers through trade missions, building direct relationships, and potentially creating an interprofessional association to facilitate coordination among producers and engagement with buyers.

6 Encourage entrepreneurship in the sesame hulling sub-sector through grants and integration into existing agricultural extension training programmes.

7 Maintain the focus on road development in outlying areas to reduce transport costs and improve access to major production regions. This should be prioritised in national spending plans.

Teff

Teff, a grain that has been cultivated in Ethiopia and Eritrea for 3,000 years, has recently emerged as a promising nutraceutical due to its high levels of calcium, protein, vitamin C, iron, and fibre, and absence of gluten. This has allowed it to cater to the growing gluten-free market and gain popularity among athletes worldwide, particularly Ethiopian runners. The grain’s use in grain-based foods like bread, pasta, and ethnic foods has increased, suggesting its potential to become a significant player in the rapidly expanding health food market. Since 2010, teff has become a global commodity with the Ethiopian diaspora, Ethiopian restaurants, and injera (a traditional flatbread made from teff) exports driving its demand26.

The rise in Ethiopian immigration to the US has spurred an increase in teff consumption, both as traditional Ethiopian cuisine and as a health food option incorporated into American staples like pancakes and waffles. These teff-flour products, touted as healthier and gluten-free, have become a staple of the American gluten-free market. Despite this, much of the teff consumed in the US is produced domestically or in countries with similar climates like Australia, due to the high costs associated with traditional Ethiopian teff harvesting and injera production. Additionally, many teff-derived products sold in developed countries emphasize organic, sustainable production, a criterion that the current Ethiopian teff sector, relying heavily on industrial fertilisers and crude threshing processes, is not well-prepared to meet. This poses challenges for the export potential of Ethiopian teff, despite its health benefits and growing global popularity.

Ethiopia, despite its potential to dominate the global teff market, faces significant challenges. Its teff productivity is low due to the lack of mechanisation in production and high labour costs, as teff grains are manually harvested using sickles. The crop also suffers substantial yield loss, between 8% and 30%, primarily during the threshing stage.

Additionally, Ethiopian teff producers may face difficulties meeting international quality standards, which could hinder the scaling-up of exports. The required certifications, such as HAACP, demand exacting quality standards that might necessitate changes in the production process. Furthermore, concerns about the purity of Ethiopian teff could raise quality control issues. To compete globally, both labour cost and yield loss issues must be addressed, and producers need to meet stringent international quality standards.

Teff, with its health benefits and gluten-free properties, holds immense potential as an Ethiopian export. However, challenges like low mechanisation and quality control issues need addressing.

The following recommendations could enhance its status as a top-performing export:

1 Liberalize teff exports: Remove all export restrictions on teff, potentially replacing the export ban with a duty to encourage domestic supply while avoiding over-exportation.

2 Improve mechanisation: In conjunction with liberalization, invest in research and development of specialised equipment for teff harvesting and threshing.

3 Overhaul extension for teff: Use agricultural extension services to improve planting and harvesting techniques and increase access to mechanised equipment.

4 Include teff in the ECX: This could streamline supply, enhance quality control, eliminate middlemen, and ensure fair market prices for farmers.

5 Develop organic teff: Given the overlap between the health-grain and organic markets, organic certification could be a strong asset for teff producers willing to switch to natural fertilisers.

Quinoa

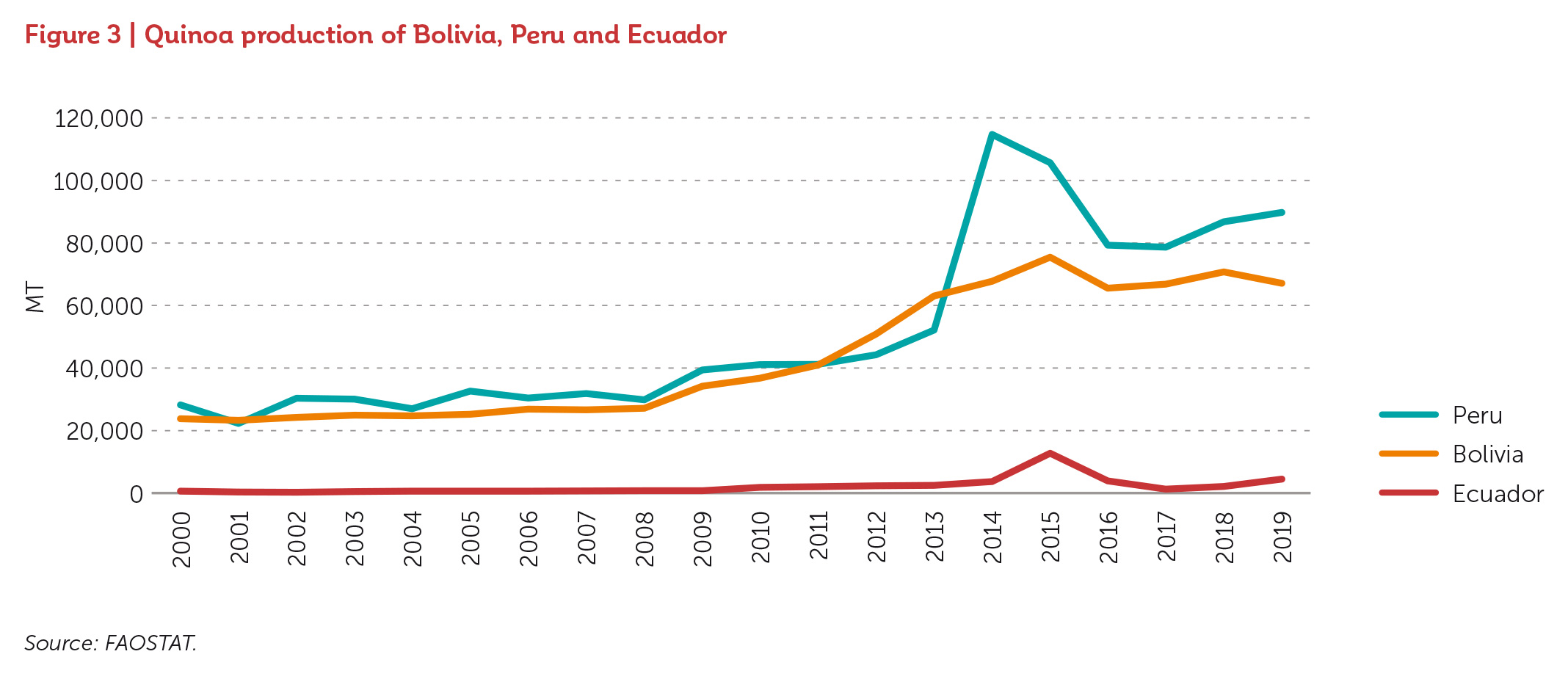

Quinoa, a crop native to the Andes mountains, has displayed immense potential as a nutraceutical product. Traditionally, it has been an important staple food for the indigenous Bolivian population, who continue to consume it frequently. Recent shifts in urban attitudes have led to the destigmatization and increased consumption of quinoa in urban areas.

Bolivian cooperatives, NGOs, and the Bolivian government have all made efforts to develop and promote quinoa production. This was further reinforced by the United Nations declaring 2013 as the International Year of Quinoa, causing a boom in its demand and profits. The demand continues to grow in developed countries, where quinoa is gaining reputation as a superfood.

Quinoa is highly nutritious, providing all 17 essential amino acids that humans require, thereby making it a complete protein. It also offers a gluten-free dietary option, a trend particularly popular in developed countries. Bolivian quinoa is organic and GMO-free, attributes that are likely to bolster its appeal in the health food market. Despite relatively limited modern research, the successful cultivation of quinoa is largely thanks to the indigenous knowledge of Bolivian farmers, making it a crop with significant value, contributing to poverty reduction in rural areas.

Quinoa has now established itself as an alternative to wheat and other grains in developed countries, and demand for quinoa should further increase over time. Currently, the two largest quinoa producers in the world market are Bolivia and Peru.

Since the quinoa boom of 2013, over 40 other countries around the globe have sought to enter the quinoa market. However, countries outside of the Andes have been stymied by lack of knowledge and experience growing quinoa. As a result, in 2017 Bolivia produced 66,700 MT, Peru produced 78,700 MT, and Ecuador produced 1,300 MT. All other countries produced negligible amounts.

Quinoa has positioned Bolivian agricultural products as organic and high-quality, but there is potential to expand its exportation. Key recommendations for growth include:

1 Sustainability: Ensuring quinoa cultivation remains sustainable is critical. Strategies include modernizing and mechanising farming, maintaining community stability, and focusing on sustainable farming practices such as intercropping.

2 Investment and Cooperation: The Bolivian government should invest in development, partner with cooperatives and companies, and harness the expertise of Andean Naturals and Andean Valley to advance the food manufacturing industry.

3 Yield Rates and Processing: Efforts should focus on increasing yields and processing output. Concurrently, large-scale farming development must ensure sustainability and profit return to farming communities.

4 Innovation in Agriculture: The National Institute for Innovation in Agriculture and Forestry should support agricultural development, such as mitigating soil degradation and exploring alternative organic fertilisers, like llama manure.

5 Land Usage: Robust community management strategies surrounding land usage should be reinforced. Cooperatives can play a significant role in developing local rules for maintaining proper land usage ratios between grazing and quinoa production.

6 ‘Repeastization’: This process, involving people returning to villages to farm, should be managed to maintain the fabric of the community, ensuring returnees are invested in the village’s success.

7 Support and Training: The government should support the creation of tools and machines for quinoa production and provide educational programmes to train farmers in using these tools sustainably.

8 Irrigation Systems: Given the risk of climate change-induced droughts, the development of irrigation systems for the Altiplano highlands is vital. This is especially important as traditional sources of water, such as glaciers, are rapidly disappearing.

Considerations regarding market access constraints

As mentioned earlier, there isn’t much information available about potential markets for exporting nutraceutical products. Nevertheless, there is a noticeable change in the consumption patterns of people in developed countries, resulting in an increased demand for health-enhancing specialty products such as nutraceuticals. This shift presents an opportunity for countries that have a natural comparative and competitive advantage in producing nutraceuticals and other high-value natural products for the health, pharmaceutical, and cosmetic industries to diversify their exports. These non-traditional export goods can significantly contribute to export diversification and the structural transformation of countries that are structurally disadvantaged, such as LLDCs. This will enable them to participate in the Global Value Chains (GVCs) for the production and supply of nutraceuticals worldwide. However, linking producers of nutraceutical products to the GVCs is not an easy task, as it involves a complex process from both the supply and demand sides.

From the producers’ point of view, businesses in structurally disadvantaged economies have to overcome significant and numerous constraints when exporting to global markets. These constraints are primarily due to high transaction costs, inadequate physical infrastructure, weak institutional capacities, limited skills, and ineffective policy implementation. The most critical constraint, however, remains the development of their productive capacities. These encompass a wide range of elements, including technological and production capabilities, financial resources, infrastructure, private sector development, institutions, energy supply, efficient market systems, and the skills and policy-implementing capacities needed for a country to produce a diverse array of goods and services for domestic consumption or competitive exports. UNCTAD defines these as the ‘productive resources, entrepreneurial capabilities, and production linkages which together determine the capacity of a country to produce goods and services and enable it to grow and develop27’.

These capabilities collectively enable a country to diversify its economy, add value, produce a broad range of products and services, create well-paying and decent jobs, promote technological learning, improve labour productivity, address environmental challenges, initiate structural transformation, and begin producing new and dynamic products such as nutraceuticals. In essence, the most effective way to advance in development and climb the value and technological ladders, ultimately escaping dependency on commodity exports, is to build and strengthen productive capacities. Market pull of nutraceuticals creates significant opportunities in this which are, however, muted by market access challenges.

A distinction may have to be drawn between market access and market entry. Market entry constraints pertain to demandrelated issues and whether markets are open to imports from other countries. Many LLDCs, particularly those in Africa and classified as LDCs and do not face market access problems. This is primarily due to duty-free and quota-free preferential market access opportunities offered by development partners for LDCs and by the US through the Africa Growth and Opportunity Act (AGOA) for African countries.

However, having market access opportunities does not guarantee easy or uncomplicated entry into these markets. In fact, the most significant constraint for LLDCs and LDCs is the capacity for market entry, even into markets where access is readily available due to preferential market access offers.

For exports of nutraceuticals and other health-enhancing products, the most significant constraint is the adherence to standards, quality control measures, and health-related safety requirements imposed by export destination countries to protect their citizens. These non-tariff measures often create obstacles for exports from LLDCs, and these measures tend to be particularly strict for products marketed as health-enhancing or supplementary to modern medicines. Over the past decades, there has also been an increase in ‘private standards’ introduced by food distributing companies in developed countries. Consequently, exporters from LLDCs will increasingly have to navigate not only public standards but also private standards, which tend to be more stringent.

Understanding the standards and regulations governing the importation of nutraceuticals in major markets is critical for potential suppliers or exporters of these goods from LLDCs. In this respect, the study further considered and analysed a sample of countries that are considered important markets for nutraceuticals and related products namely, EU, USA, Japan, China, Korea and India.

Conclusions and recommendations

Case studies showcase the considerable potential in vulnerable countries for developing or expanding exports of specialty foods and nutraceuticals. Some LLDCs are the best or the only location for growing certain specialty foods or the ingredients in them. Examples include quinoa in the Andes, cardamon in mountainous South Asia and frankincense in Ethiopia. Further, indigenous populations are often repositories of information about growing and using products that they have used for centuries such as quinoa in Bolivia.

Well-to-do and globally informed consumers in developed countries are increasingly seeking alternatives to standard medicine. They also often want to help alleviate poverty, preserve traditional cultures and promote environmental sustainability in the most vulnerable countries in the world.

The potential of nutraceuticals stems from consumer interest to promote their own health while also contributing to the wellbeing of people in producing countries. Relatedly, social entrepreneurship is a rising area of interest to students in business schools and there has been a burgeoning of NGOs and private investors who aspire to assist poor countries while creating successful enterprises. These social entrepreneurs may be from LLDCs themselves but have experience with international firms and have cutting-edge management skills and networks. The French cosmetics firm L’Occitane’s role in developing and using shea from Burkina Faso can be mentioned. Another example is Andean Naturals, one of the main companies exporting quinoa from Bolivia. The company was founded by a Bolivian who attended the University of California business school. It is based in California with offices and processing operations in Bolivia.

What can LLDCs do to overcome the obstacles and take advantage of the opportunities? The case studies provide several avenues that are summarized below:

Attract foreign direct investment and global buyers

The demanding quality requirements for nutraceuticals and the ingredients therein require state of the art growing and processing techniques. These skills are mainly found in larger global companies who could pay premium prices to farmers for high quality produce. For example, L’Occitane, the pioneering cosmetics firm in the shea butter market, requires all cooperatives it works with to adhere to the Ecocert sustainability and quality standards. L’Occitane pays roughly double the local market price per kilogram of butter, more than offsetting the costs of annual certification, advanced processing equipment, and hiring experienced managers. It is essential to attract and partner with such companies. This does not mean large subsidies which are often misused and unaffordable for LLDCs. Instead, the most important consideration is to create a hospitable environment for entrepreneurship, both international and domestic. Barriers to FDI such as limits on the share of companies owned by foreign investors should be removed except perhaps for a few strategic sectors.

Improve the overall business climate

To foster both FDI and local entrepreneurship—and collaboration between them—the overall business climate should be improved. While it is unreasonable to expect the quality of infrastructure and public services to be as high in LLDCs as developed countries, reducing the complexity and cost of registering businesses and handling containers need not be expensive. Investment in infrastructure is costly and governments must prioritise. The case studies show that roads connecting agricultural areas are a high priority. A reliable supply of electric power is also essential for all facets of production including cold storage facilities. Foreign investors usually can source in alternative locations and will go where they feel most welcome and are most productive. A case in point is the departure of Lotus Foods from Bhutan where they were sourcing red rice production in favour of Madagascar.

Technical assistance from NGOs and international organisations

The product case studies discussed in this report have revealed numerous instances where beneficial collaboration between international aid agencies and farmers and governments have led to win-win outcomes. For example, the regional research centre International Centre for Integrated Mountain Development (ICIMOD) and Environment Conservation and Development Forum (ECDF) in conjunction with the Rural Livelihoods and Climate Change Adaptation in the Himalayas (Himalica) Programme have been helping farmers in Bhutan and Nepal adapt to the changing climate and properly manage their cardamon plantations. In Bhutan, the Himalica programme has developed 12 pilot demonstration farms to teach by example through on-site coaching and training in crop management. These demonstration farms emphasize the use of weather tolerant crops and best management practices. The programme encourages farmers to use intercropping to maintain soil nutrients and diversify into nitrogen- fixing beans. Keeping with Bhutan’s commitment to minimal environmental impact, the Himalica programme promotes the use of improved dryers that require less fuel wood. By using less wood, farmers can shrink their carbon footprint.

Environmental preservation

As noted above, most LLDCs have the crucial advantage of propitious natural environments for some specialty foods. In many cases, however, the trees or plants that are the source of nutraceutical products are under severe stress due to neglect or overuse, exacerbated by climate change. Frankincense has sturdy drought resistant bark and its ability to grow and prevent erosion in rocky, steeply sloped where few other trees can thrive. Frankincense is thus well suited to Ethiopia’s landscape as well as highly prized for its medicinal properties. Yet frankincense production in Ethiopia is threatened by illegal conversion of forests into farmland and over-tapping of trees. It is imperative that governments take steps to preserve the sustainability of the soil and forests. At a local level, cooperatives can help implement better practices but oversight by a central authority is also required.

Support cooperatives for small farmers

Cooperatives have proved to be very positive forces for organising smallholder farmers and providing local public goods. The economic advantages of cooperatives involve pooling of resources to mitigate risk and diffusion of knowledge to improve productivity and quality. Agricultural cooperatives have been particularly vital to informing farmers about the importance of quality inputs and facilitating their access to inputs. Cooperatives played a large role in enabling Bolivian farmers to produce quinoa for export by raising standards and adopting sustainable farming practices. Beyond production improvements, cooperatives have also been helpful in increasing the quality of life across the board in rural communities. The cooperative model is based on democratic decision making among the small farmers in the cooperative and, consequently, it results in an institution that is tied directly to the local communities. As a result, cooperatives tend to be responsive to the communities’ needs. In addition, cooperatives often serve as a countervailing force to government agencies and processors. Indeed, in Bolivia and elsewhere cooperatives are structured like unions. The cooperative headquarters supports interactions at the multinational level and secures fair prices leaving the local village cooperatives to conduct the day-to-day activities of cooperatives.

Leverage trade associations

Trade associations can help organise production and distribution. A case study in the report shows how the Azerbaijan government has prioritised this approach, notably in hazelnuts. The Azerbaijan Hazelnut Exporters Consortium (AHEC) is composed of the five major companies involved in the processing and exporting of Azerbaijani hazelnuts. The consortium organises collection of hazelnuts from 12,000 small Azerbaijani farms and promotes greater market access for the export of Azerbaijani hazelnuts. The consortium also promotes modernization of production techniques and food safety standards that meet the norms of developed countries. A possible downside is excessive market power of associations.

Develop competent government extension and quality control services

LLDCs should build the institutions and programmes necessary to assist local firms in raising productivity and meeting quality norms. Many small farmers lack the knowledge and capabilities required for enhancing-productivity and managing sanitaryimproving technologies. Information about quality inputs, notably seed and fertiliser is important. In the past decade there has been a global shift in food regulation from policing to facilitating. Instead of punishing violations, developed country food safety agencies now focus on working with producers to prevent incidents. LLDCs can move forward by developing their own domestic food safety agencies that could partner with developed country counterparts. These agencies can help facilitate cooperation between different stakeholders in the agricultural industry. Of course, it is not sufficient to create more of the underfunded agencies that unfortunately have proliferated in some LLDCs. Agencies must be staffed by professionals with up-to-date expertise in agriculture and be shielded from political favouritism.

Greater mechanisation

While developing countries should take advantage of their abundance of labour wherever possible, in some cases artisanal cultivation and processing technologies have very low productivity and provision of equipment for harvesting, washing, and threshing can make the products more competitive, as demonstrated in the case of teff in Ethiopia.

Marketing assistance

Some LLDCs, depend heavily on one or a few foreign markets. For example, Bhutan and Nepal both depend very heavily on India. This is due in part to the dominance of Indian traders in handling Bhutanese produce. This partly reflects lack of information available to farmers and cooperatives on alternative markets. Foreign companies from developed countries are well placed to assist diversify market access. Establishing trade offices abroad may be useful, as in the case of Azerbaijan.

Develop organic production

A fast-growing niche market, organic-certified produce has become a significant sub-sector of the produce market in developed countries. Over the past decade, health food stores have shifted their sourcing to largely or exclusively to organic produce, and most large supermarket chains now allocate a meaningful percentage of their produce stocks to organic produce. Many traditional small farmers do not use chemicals, so they are already organic de facto, but not certified as such. The organic market presents a lucrative opportunity to producers in LLDCs, but organic certification is an intensive and time-consuming process. The primary constraint for many smallholder farmers seeking certification is the difficulty of switching to non-pesticide-based pest management. A significant investment is required to deploy systems like integrated pest management, and if done improperly the entire harvest can be put in jeopardy.

Expand processing where appropriate

The extent to which processing of produce into nutraceuticals is feasible for LLDCs varies by country and product. Countries should only promote local processing where the processes are not overly complex and capital-intensive. For example, sesame hulling provides a viable value addition with noticeable price premiums and little capital-intensity unlike the production of sesame oil. In general, successful processing requires partnerships with foreign companies with specialised expertise. For Burkina’s sesame processing, the country is assisted by the NGO Lutheran World Fund and the vegetable oil company Olivera. Processing of frankincense in Ethiopia is not a high priority given the high prices the country can obtain from unprocessed exports; the main priority is to preserve the frankincense trees, as noted in this report.

Facilitate the participation of women in the development, production and sales of nutraceuticals

Access of the poor and women to productive assets such as land and capital are critically important for effectively and fully harnessing the potential of nutraceuticals for jobs creation, poverty reduction and sustainable growth and development. Deliberate policies and concrete actions are necessary to promote, particularly gender equality, improve the productivity and growth prospects of nutraceuticals development and valueaddition across the countries discussed in this study. Genderbased obstacles highlighted through the Burkina Faso case study on the shea sector are typical for the agriculture sector in developing countries more broadly, while gender-based obstacles can be found in all sectors and all countries. To move towards a level playing field it is necessary to remove such gender-based obstacles and entry barriers to the poor. These should include legal reform of land tenure; bans on gender-based discrimination in marketplace settings; establishment of well-resourced funds to address gender inequality, including providing capital funding for female-led projects; creation of land-purchasing cooperatives for women; subsidies for female farmers to reduce dependence on male family members; targeted training offer for women, adjusted to their time-poverty and schedules dependent on reproductive and care responsibilities; creating platforms and networks supporting linkages and provision of market intelligence for female entrepreneurs, among other actions. These actions are also necessary to target poor households and other vulnerable sections of the society who lack productive assets due to unequal distribution of land and capital.

Consider registering geographical indications or trademarks

LLDCs should consider the use of Geographical Indications or trademarks to support the branding and marketing of their nutraceuticals. In doing so, LLDCs should weigh the potential costs of implementing Geographical Indications or trademarks, including supporting the collective organisation of producers and processors, setting up Codes of Practise, establishing marketing and surveillance mechanisms, all with the potential benefits in terms of greater economic profits, fostering quality-production, strengthening collective action, as well as improved management of biodiversity resources. Ideally, efforts to register Geographical Indications or trademarks should be part of a broader marketing and sustainability strategy. This requires establishing a reputation for quality and reliability and, very likely, partnering with foreign firms who have the marketing expertise and connections to successfully establish a brand. An example is the US-Bolivian company Andean Naturals in Bolivia which has established brands for quinoa such as Royal Quinoa. LLDCs can also request technical assistance from a range of United Nations bodies for the implementation of Geographical Indications. Member states can also request assistance from CFC for further facilitation in this regard.

2 https://openknowledge.worldbank.org/handle/10986/28040

3 https://blogs.worldbank.org/psd/economic-diversification-priority-action-now-more-ever

4 https://www.weforum.org/agenda/2022/01/least-developed-countries-ldc-technology/

5 https://unctad.org/publication/commodities-and-development-report-2021

6 https://www.undp.org/sites/g/files/zskgke326/files/publications/Towards_SustainingMDGProgress_Chapter1.pdf

7 https://unctad.org/publication/exports-diversification-and-employment-africa

8 https://cmi.comesa.int/wp-content/uploads/2020/11/THE-ROLE-OF-EXPORT-DIVERSIFICATION-FOR-ECONOMIC-GROWTH-AND-EMPLOYMENT-CREATION-IN-AFRICA.pdf

9 https://www.ilo.org/wcmsp5/groups/public/---ed_emp/documents/publication/wcms_452341.pdf

10 UNCTAD, 2015. Facilitating the Relationship of Landlocked Developing Countries in Commodity Value Chains. UNCTAD/ALDC/2015/2

11 Project CFC-2019-14-0001FT ‘Harnessing the potential of nutraceutical products for export diversification’.

12 The term ‘nutraceutical’ itself is a blend of the words ‘nutrition’ and ‘pharmaceutical.’ It doesn’t fit neatly into the categories of typical foods or medicines, but rather occupies a middle ground. Furthermore, in many countries, nutraceuticals are subject to less stringent regulations than medications, and determining which products possess healthboosting properties that set them apart from ordinary items can be somewhat subjective.

13 ‘Surge in Court Cases Over Climate Change Shows Increasing Role of Litigation in Addressing the Climate Crisis.’ Retrieved from Prevention Web: https://www.preventionweb.net/news/view/75726.

14 https://unctad.org/topic/trade-and-environment/biotrade

15 Weiss, C. & Eisner, T. (1998). Partnerships for Value-Added through Bioprospecting, Technology in Society 20: 481–498

16 Royal Spices (2017). ‘Big Cardamom.’ http://www.bhutanbigcardamom.com/#

17 Streit, L. (2018). ‘10 Health Benefits of Cardamom, Backed by Science.’ Healthline Media. https://www.healthline.com/nutrition/cardamom-benefits

18 Bhutan Natural (2018). https://www.bhutannatural.com/about-us

19 Jadav, K.D., Mehta, B.M. ‘Cardamom: Chemistry, Medicinal Properties, Applications in Dairy and Food Industry: A Review’, Research and Reviews: Journal of Dairy Science and Technology, Vol. 7 (2018), Issue 3, pp. 9–19

20 Pangea Organics (2019). https://pangeaorganics.com

21 Gautam, A. (2017). ‘Large cardamom price plunges three-fold.’ The Kathmandu Post. https://kathmandupost.com/money/2017/04/15/large-cardamom-price-plunges-three-fold

22 Jamwal, N. (2018). ‘Rise after the fall.’ Down To Earth. https://www.downtoearth.org.in/news/climatechange/rise-after-the-fall-61505

23 Yonten, K. (2017). ‘Bhutan Cardamom inferior due to poor drying practices.’ The Bhutanese. https://thebhutanese.bt/bhutan-cardamom-inferior-due-to-poor-drying-practices/

24 Gildemacher, P., Audet-Bélanger, G., Mangnus, E., van de Pol, F., Tiombiano, D. & Sanogo, K. (2015). Sesame Sector Development: Lessons Learned in Burkina Faso and Mali. KIT & CFC, Amsterdam

25 https://www.fortunebusinessinsights.com/cold-pressed-sesame-oil-market-103678

26 https://www.weforum.org/agenda/2019/03/ethiopia-needs-to-improve-production-of-its-golden-crop-teff-heres-how/

https://well.blogs.nytimes.com/2016/08/16/is-teff-the-new-super-grain/

27 UNCTAD (2006). Least Developed Countries Report: Developing Productive Capacities. UNCTAD, Geneva

Photo: Tegemeo farmer inspecting his millet. KIT

Introduction - the re-emergence of millet

This article explores the re-emergence of millet in domestic value chains and its use by private actors with innovative business models – using fortification or biofortification – to highlight millet’s smart food properties. While millet has been in the shadow of rice and wheat production for decades, recently there has been renewed interest in millet to enhance food security and livelihoods for small farmers. According to the CGIAR, the development of new millet products ‘needs to make business sense for farmers, seed suppliers, food producers, and consumers.’2 While the food security and climate resilience aspects of millets have been the focus of programmes targeting the most vulnerable populations, this article explores the innovators behind changing the narrative around millets: from a ‘poor people’s food’, towards a smart food (Box 1).

Millets have long been a staple food in many regions of Africa and Asia, but their cultivation declined significantly as they came to be associated with poverty and other crops and foods were regarded as more desirable and better tasting. As part of growing efforts to revive global millet production and consumption, the United Nations and its Food and Agriculture Organization, on India’s request, named 2023 as the International Year of Millets (IYM 2023). Two key properties of millets are repeatedly highlighted: first, their climate-smart properties, as millets can be cultivated in adverse and changing climatic conditions, with few inputs. These cereals can be a potential solution for many regions’ selfsufficiency and reduction of reliance on imported cereal grains.3 Second, millets’ health benefits as compared with other cereals: elevated levels of protein, fiber, key vitamins and minerals, including iron, zinc, and calcium.4 In addition to their nutritive value, millets are the main cereal for many cultural, ceremonial (funeral, wedding and baby showers) and religious (especially during the Muslim fasting month Ramadan) foods. Millets are gluten-free and have several potential health benefits relevant to cardiovascular diseases and diabetes, among others (Saleh et al., 2013).

The FAO’s goal in 2023 is to increase awareness of millets’ production potential and enable the adoption of necessary policies which can maximise its nutritional and health benefits. Such policies should enable the creation and scaling of new sustainable market opportunities for producers and consumers.5

The following sections explore production and consumption patterns developing in key millet-producing regions, using examples of national and international ongoing public and private efforts that are affecting these patterns. Development actors, including financiers, can get new insights into the hypothetical (and audacious) question ‘should we go all in on millet?’. While the answer is likely ‘no’, the question is illustrative of the growing number of public nutrition campaigns, processors and brands which, in recent years, have started to aggressively promote millet’s nutritional and health benefits. The article includes case studies enterprises (as well as a project) which exemplify the diverse opportunities of investing in processors and brands to achieve farm-level and consumer-level impact.

Global production and consumption patterns

Production of millets

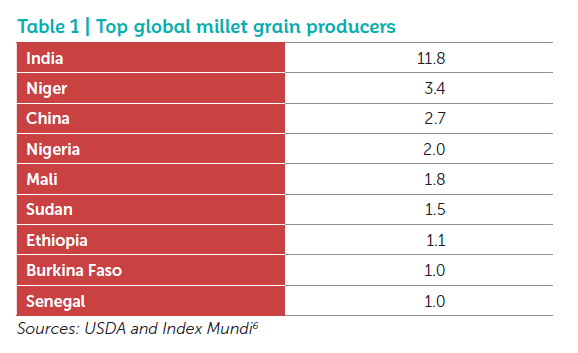

World millet production is estimated at 30.6 million tons in 2022. While millets are grown in more than 93 countries worldwide, only a few countries have a sizable production. India alone is responsible for 39% of global production, followed by Niger (11%) and China (9%). As a region, West Africa is the largest producer (Table 1).

In most millet producing Low- and Middle-Income Countries (LMICs), the crop’s production has declined over the past decades due to shifts to other staples, changed food habits, and ensured returns from major commercial crops (Meena et al. 2021). Only few countries, including China, recorded increasing production levels. Recently, however, there are different efforts underway to put millet back in the global spotlight. In India, the government has promoted millet production for over a decade already, starting with rebranding millets as ‘nutricereals’ instead of calling them ‘coarse grains’.7

Millets’ characteristics as dryland cereals make them much more resilient crops than maize and other major cereals and offer good insurance against crop failure. Millets offer shorter maturity periods – around 60-90 days for some cultivars - and lower post-harvest losses than other staples (Kaminski & Christiaensen, 2017). These can be important advantages for small-scale farmers, who account for the large majority of worldwide millet production, particularly as millets can be grown on arid lands and nutrient-depleted soils with minimal inputs such as water or fertiliser (Hassan et al., 2021). Finally, unlike wheat, maize and rice, millets emit little or no greenhouse gases (Saxena et al., 2019).

There are still a number of major production constraints, including limited access to modern equipment and technologies, such as good quality seeds and improved varieties and incidences of diseases, pests and weed infestations. Additionally, traditional methods of post-harvest processing (dehulling) are labor-intensive and time-consuming, and modern processing facilities are limited (Meena et al., 2021). In Mali, for example, according to the Institute of Rural Economy, the main challenges in promoting millets include limited availability of millet grains as raw material to processors, unattractiveness of packaging of end products, difficulties in transportation and storage, lack of capital to invest in machinery, lack of available equipment leading to manual labor still widely spread which limits outputs, and a lack of millet-specific capacity building for processors.8 These challenges speak to the underinvestment in and underdevelopment of millet value chains in major production countries, which makes it difficult to scale up production and meet the growing demand for millet products.

Consumption of millets

The Sahel region of Africa dominates global consumption of millets, followed by India, as the largest single consumer of millets. Most millets are consumed where they are produced, but there is also growing trade and important importers include Indonesia, Germany, Iran, Belgium and South Korea, among others.

About 80% of the millets produced are used for human consumption, while the rest is used as animal fodder and for beer production (Vinoth & Ravindhran, 2017). Individual kernels are commonly ground to make flour, which is then made into a thin or thick consistency porridge in many African countries, while in other areas it is consumed as a flatbread (e.g., dosa in India) or baked into a fried cake (e.g., masa in Nigeria) (Hasan et al., 2021). The shelf life of millet flour is short due to the presence of polyunsaturated (healthy) oils but can be extended using heat treatments and/or antioxidants (such as vitamin E or rosemary extract).9

Millets fell out of favor in many countries and started being seen as an old-fashioned poverty crop. In Senegal, for instance, consumption fell from 78 kilograms per capita in 1990 to 49 kilograms per capita in 2009 (Resnick et al., 2020). In India, per capita consumption of millet fell from 32.9 kg to 4.2 kg between 1962 and 2010.10 British colonizers disregarded millets in favor of wheat and other crops but with the Green Revolution millets’ downfall accelerated as the government pushed for hybrid, high-yield varieties of wheat and rice.11 Crops that were once widely consumed became mere fodder crops. Millets gained a reputation as the food of rural and tribal communities and over time, they simply disappeared from households’ menus.

Recently, millets’ diverse health and environmental benefits are beginning to be appreciated once more. In the example of India, this is partly due to the country facing the triple burden of hunger, malnutrition and over-nutrition, whilst environmental resources are being depleted. The Indian government made significant investments in promoting millets’ many qualities to urban and rural consumers. Demand for millets is increasing and the crop is finding its way back into Indian diets.

At a global level millet is making an impressive comeback, with the global market being estimated at $9 billion in 2018. This is expected to grow to more than $12 billion in 2025.12 Drivers for the anticipated growth are millets’ production advantages over rice and wheat, in particular in a dry climate, and the cereals’ multiple health benefits, including calcium, iron, fibers, vitamins, phosphorus, magnesium and manganese. Rising awareness towards healthy diets is expected to drive growth, especially among the rising urban population in Asia. As millets are also gluten-free, they offer opportunities to produce gluten-free products.

In sub-Saharan Africa, and especially in West Africa, many processors are promoting millet consumption by proposing new types of ready-to-cook or ready-to-eat millet foods (as opposed to selling millet products which require overnight processing (i.e., soaking) at home). For example, in Mali, a variety of new millet products are available in most small food stores, supermarkets and outdoor markets, such as couscous, granules of porridge and cream (Degue), millet flour, Larau (a mix of millet, groundnut and spices), millet biscuits, breads, pane cake, Takoula (bread made on vapor), infant foods, etc. In urban areas of Mali millet is considered a cereal for rich people, as higher prices of new millet products make these unaffordable to low-income consumers. Millet is used in many breakfast foods (porridge, fried cake, pane cake), often sold by women in small stands in urban areas.

Today the growing demand in West African countries leads to one of millet processors’ main challenges: the low supply of raw material, i.e., millet grains. Although the effort will take long, Indian urban consumers are being educated in the tastes and benefits of new millet products, and here too, demand is on the rise. It remains to be seen if international (Western) markets will catch up.

Millets as a superfood

The United Nations estimate that almost 3.1 billion people could not be able to afford a healthy diet in 2020, an increase of 112 million more people than in 2019 due to rising food costs. Particularly in Africa, a healthy diet is out of reach for 80% of the population, followed by Asia with 44% (FAO et al., 2022). While this may not lead to obvious hunger effects, it can cause different forms of malnutrition, including undernutrition, micronutrient deficiencies and overweight / obesity (FAO, et al., 2022). Micronutrient deficiencies are widespread, as people rely on staple foods, such as rice, which are low in micronutrients to meet their energy requirements (FAO et al., 2022). Hence, improving micronutrient availability in foods, especially iron (Fe) and zinc (Zn) is important to address underlying causes of malnutrition.

Different efforts to deliver nutrient-dense foods to poor populations can be distinguished: (1) food fortification and (2) biofortification. Fortification is the practice of deliberately increasing the content of one or more micronutrients (i.e., vitamins and minerals) in a food or condiment to improve the nutritional quality of the food supply and provide a public health benefit with minimal risk to health.13 The usage of millets in fortified products has already gained some traction in infant food and nutrition products. Many countries have laws or policies to promote the use of post-harvest, industrial fortification to add iron to flour and other foods, but they are rarely enforced.14 In addition, while fortification is a cost-effective strategy, it remains difficult to ensure the availability of these fortified foods to people living in remote areas (Gangashetty et al., 2021).

Photo: KIT