Annual Report 2022 II

Photo: Negotiating price of corn seeds at the cereals market, Ouagadougou, Burkina Faso. © FAO/Giulio Napolitano

There have been three major food price spikes in the current century. The first two occurred in 2007-2008 and 2010-2012. We are currently living through the third which has followed the COVID-19 pandemic and the war in Ukraine1.

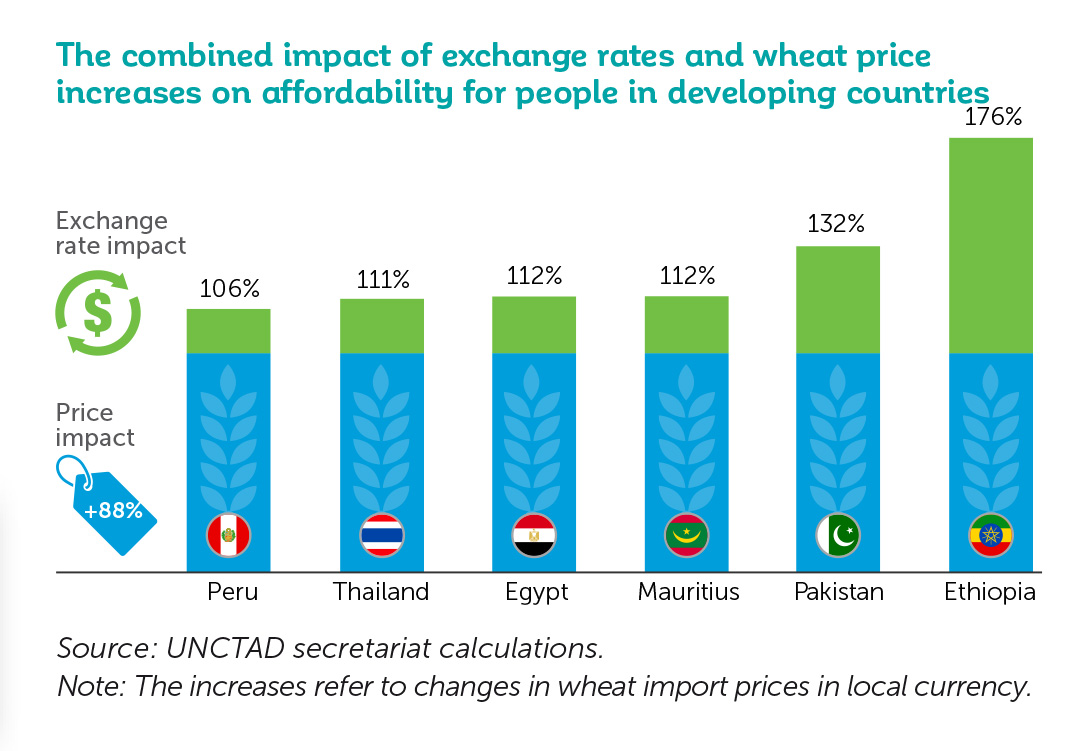

What differentiates this third spike from the others is the simultaneous strengthening of the US dollar, which intensifies its negative impacts on the world’s poorest people. During the initial two spikes, food prices increased as the value of the US dollar decreased. This depreciation of the US dollar, coupled with the appreciation of other currencies, made imports more affordable, easing food import bills for many developing countries.

The current situation is a new and more challenging scenario for many. In response to high inflation in the United States, the Federal Reserve elevated its interest rates, leading to a 24% appreciation in the US dollar from May 2021 to October 2022. This increase presented a dual challenge to developing countries: rising food prices and the depreciation of their local currencies against the US dollar, which they use to purchase food.

Furthermore, the strengthening dollar has made loan repayments more expensive for many borrowers. This has escalated issues around loan provisioning and debt stress, which has made fiscal discipline and economic stability harder to achieve in 2022.

As of October 2022, the average price of wheat was 89% higher than the average in 2020. The exchange rate effect then amplifies that increase. As the graph below shows the combination of rising prices and currency depreciation led to estimated price increases ranging from 106% to 176%. This illustrates how the exchange rate effect drives up food import bills and contributes to inflation, the loss of purchasing power and food insecurity. The situation has been compounded by extreme weather events, putting smallholder farmers’ agricultural activities and livelihoods at greater risk.

An international response

Many of the agri-SMEs we invest in – and the smallholders they support – operate in countries that rely on imports from Ukraine and are vulnerable to commodity price volatility. The instability of the foreign exchange and commodity markets has made 2022 a difficult year for them.

As counterintuitive as it seems, smallholder farmers rarely benefit from a sharp rise in the price of the crops they produce. Smallholders who grow their crops on a hectare or two of land face more constraints than multinational commodities businesses. Although their crop price may have risen, so have the inputs that enable them to farm it. Smallholder farmers also consume the products made from their crops and spend a disproportionate amount of their income on food – as shop prices rise so does the cost of feeding their families.

But thanks to international efforts, they received critical help through the Black Sea Grain initiative, which has played a crucial role in reducing food price shocks.

According to the UN World Food Programme (WFP), Ukraine exported 6 million metric tons of food on 200 vessels per month, before the start of the conflict. This dropped to an average of 1 million tons per month by land and river routes after the invasion, which led to a price spike until the Black Sea Grain initiative was signed in July 2022. Renewing the initiative in November has therefore provided a lifeline to developing and least-developed countries (LDCs), which received 10 million metric tons of grain and other foodstuffs within the first three months of the initiative.

The grain cargo levels in 2022 were still below those of 2021, but the initiative closed the gap, stabilising prices and ensuring food accessibility. It also provided Ukraine’s farmers with a reliable buyer, in the form of the WFP, giving them the certainty they need to continue planting and harvesting their crops despite the war going on around them.

Tackling the climate crisis

The effects of climate change put an additional burden on smallholder farmers. Across the world, 2022 saw extreme weather events such as drought and flooding, jeopardising agricultural activities and food security.

If strong action isn’t taken climate change is likely to intensify in the coming years. That’s why mitigation and adaptation strategies are vital for smallholder farmers. At the CFC we’re increasingly investing in agri-SMEs that support smallholder farmers to improve productivity and build resilience, while minimising their environmental impact. For instance, this year we invested USD 800,000 in Enimiro, a Ugandan exporter of organic vanilla, coffee and dry fruits. Alongside training farmers in sustainable agricultural practices, the company works with a digital traceability system that verifies the credentials of the crops they grow and the products that consumers buy. In turn, this enables farmers to sell their produce into premium markets and benefit from the fair and transparent pricing provided by the system. Go to page 89 to find out more about Enimiro’s work and how the company has built trusting relationships with vanilla farmers.

Providing support in difficult times

This deluge of issues is one reason we’ve experienced an overwhelming rise in the number of applications for our investment this year. Many of the SMEs we invest in struggle to access funding from local banks and other financial institutions, particularly at times of economic stress.

Despite the challenges, we’ve continued to engage with our current partners and explore new investments that have the potential to make commodity value chains more resilient. Our Executive Board approved 13 investment proposals, which are expected to reach about 187,000 smallholder farmers across the world, from Colombia to Indonesia.

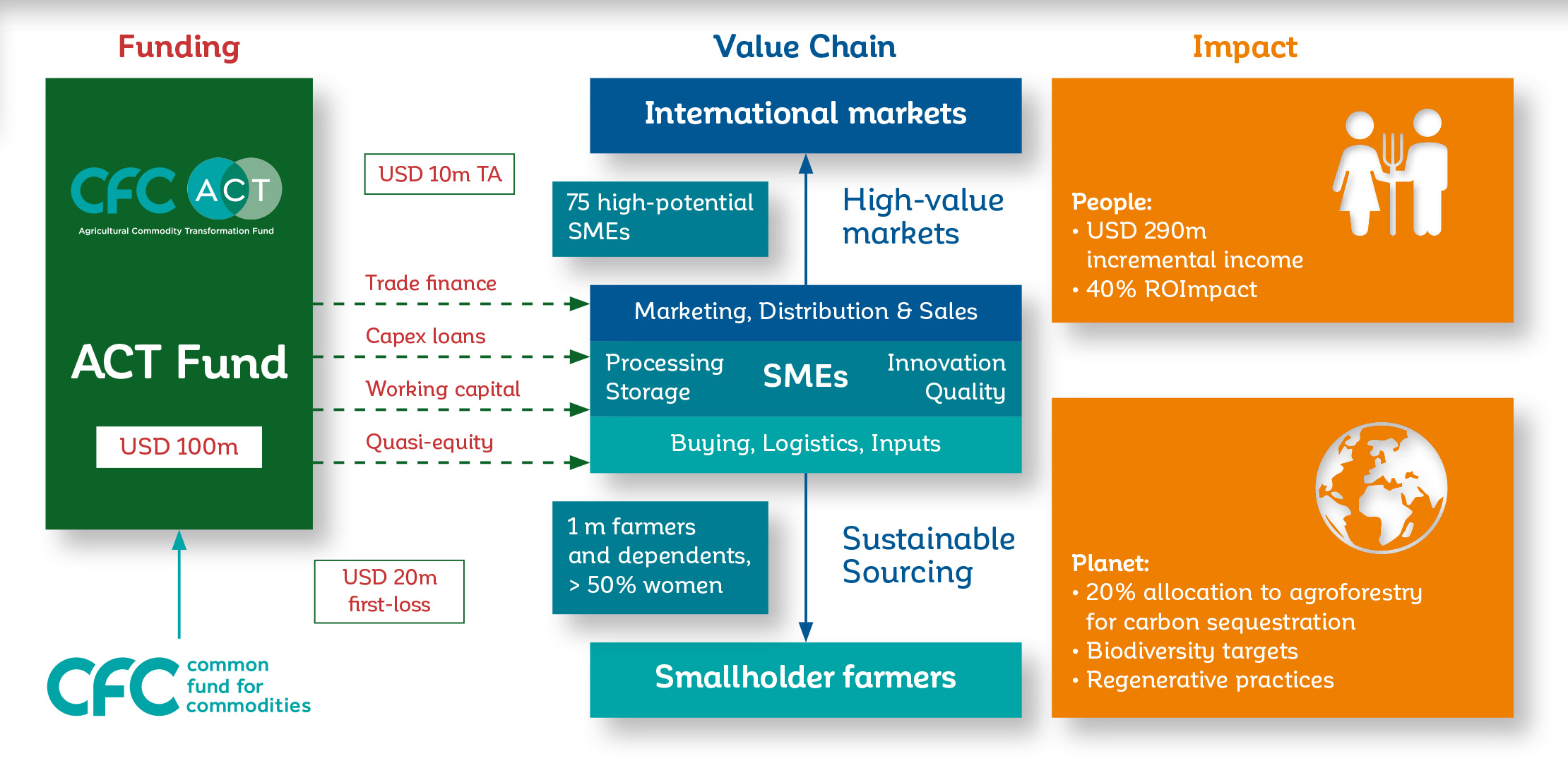

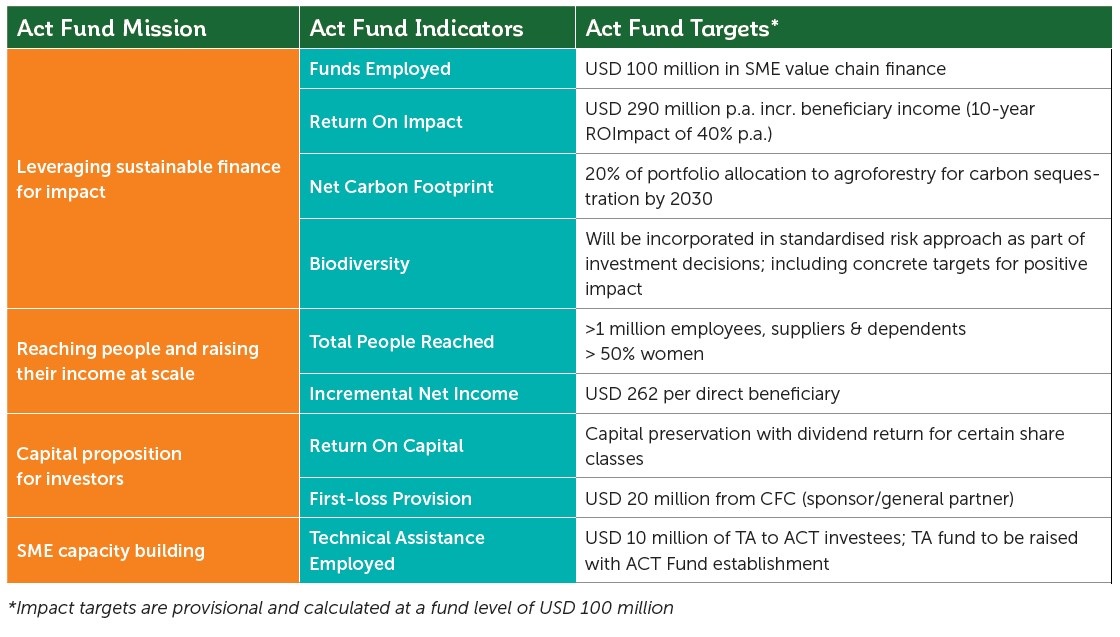

But there is a huge demand for our services, and we could only support a fraction of the proposals we received. To help bridge this gap and meet the overwhelming demand, we have worked hard to establish the Agricultural Commodity Transformation (ACT) Fund, previously the Commodity Impact investment Facility (CIIF), which will give the private sector an opportunity to invest with us.

2022 has reinforced the importance of collaborating with our partners and impact investors to provide agri-SMEs and smallholder farmers in LDCs and beyond, with the support they need to build economic and environmental resilience.

Putting SMEs at the heart of agricultural transformation

1 The information provided herein is an opinion of the authors and does not represent the position of the Common Fund for Commodities or any of its Member States. The Information is not intended for distribution or use in the US and any jurisdiction or country where it is illegal or unlawful to access and use such information. The Information does not constitute investment advice and the Common Fund for Commodities denies all responsibility for consequences of acting upon the Information. The use of this information in making financial, management or other decisions of material significance is expressly prohibited. The Common Fund for Commodities disclaims all responsibility if you access or download any Information in breach of any law or regulation of the country in which you reside and shall not hesitate to invoke articles 42 et seq. of the Agreement Establishing the Common Fund for Commodities, which grant the Common Fund for Commodities immunity from jurisdiction.

The opportunity

Small and Medium-sized Enterprises (SMEs) in developing countries play a critical role in linking smallholder farmers to global markets. However, they face challenges accessing highvalue markets due to rising costs and climate change. ACT aims to help SMEs in the agricultural sector by providing capital and technical assistance to create sustainable value chains that benefit smallholder farmers and support low-carbon practices.

Many SMEs in the agricultural sector fall into the ‘missing middle’ investment gap which means they struggle to access financing. This limits their ability to invest in improving productivity and expanding their businesses in a way that drives rising incomes and job creation, which are both critical to overcoming issues such as youth unemployment in rural areas. With 1.3 billion young people worldwide, including 10 to 12 million new job seekers per year in Africa, jobs created by SMEs are essential to provide economic opportunities and alternatives to migration.

ACT will provide the necessary support for SMEs to create sustainable, low-carbon supply chains that promote income growth and climate resilience on a large scale.

ACT will build upon the CFC’s three decades of experience in financing commodity value chains, backed by its contribution of USD 20 million in first-loss capital, world-class impact investment and Technical Assistance team, an innovative USD 10 million TA facility and an established deal flow of more than 400 applications a year.

ACT will facilitate climate-smart agriculture and market access, with the aim of creating USD 290 million in incremental income for more than 1 million beneficiaries across SME value chains, alongside carbon savings, as the fund reaches its full capacity of USD 100 million.

Investment model

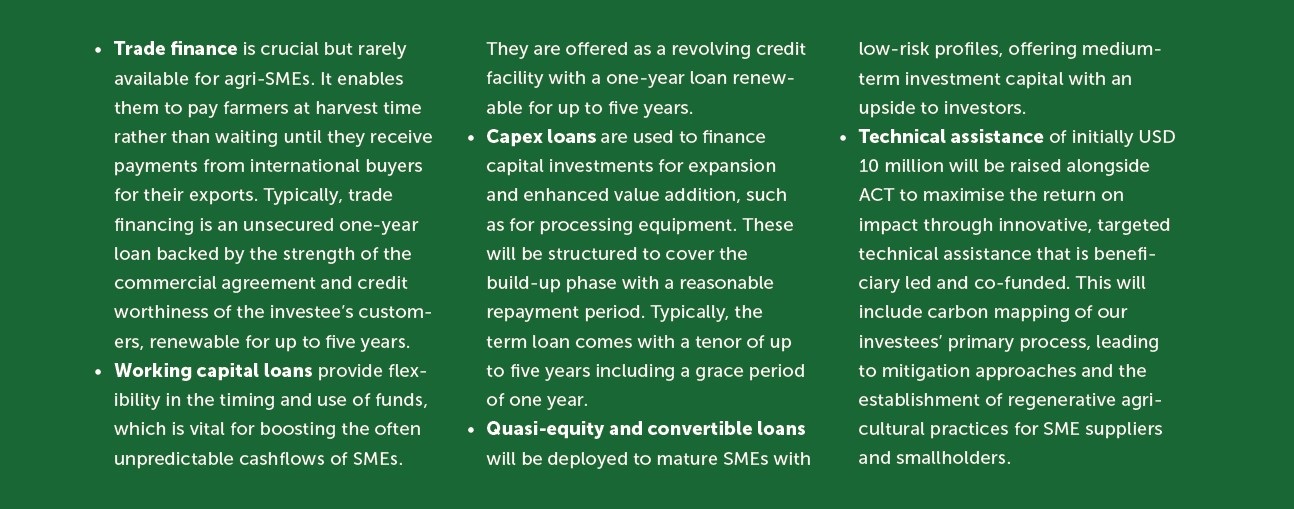

ACT will deliver an attractive balance of impact and returns for investors, with a focus on capital preservation coupled with high levels of verifiable impact. ACT will invest in established SMEs with revenues exceeding USD 1 million through a range of instruments that balance short and long-term growth. This will primarily be in the form of working capital, trade finance and capex loans, but ACT will also deploy smaller amounts of quasi-equity, as described below. This will be supported by USD 20 million of first-loss capital from the CFC, de-risking investments in ACT and demonstrating the CFC’s commitment as a sponsor and advisor to the fund.

Track record and people

At the CFC, we combine a strong track record of directly financing SMEs with the stability of an intergovernmental institution and an excellent private sector reputation in fund management over three decades. We have been originating, executing and managing trade finance and capex loans since 2014. Prior to this, since 1989 we have financed more than 500 commodity value chain development projects in developing countries.

Impact investment

Since pivoting to impact investing, we have successfully executed 50 loans, with a total value of USD 52 million, of which USD 38 million is currently committed to investees. These agri-SMEs operate in a wide variety of commodities, ranging from staple crops such as sorghum to commercial crops such as coffee and cocoa. With these loans the CFC has positively impacted the lives of 850,000 people in countries across Africa, Asia and Latin America. Our high-touch, hands-on risk management approach is designed to minimise losses and provisions in a high-risk segment.

Technical assistance

The CFC’s in-house Technical Assistance (TA) team currently manages TA facilities totalling USD 14 million for several leading agri-impact funds. The team has managed more than 100 projects ranging from piloting climate smart financing mechanisms for smallholders to the design and establishment of full scale outgrower schemes for large processing facilities.

ACT's management team

• Michael van den Berg – ACT Investment Director

Michael has two decades of experience in impact investing and financial management with a focus on mobilising, managing and deploying funds in food and agriculture across Africa, Asia and Latin America. He was the CFO of an agricultural social enterprise in Myanmar and fund manager of the global sustainable agriculture fund at Triodos. He is a director on a number of impact fund boards and has qualifications from Harvard, SOAS and IIMA.

• Fatima-Zohra Yaagoub – ACT Impact Manager

Zohra is an expert in impact quantification, measurement and development finance with a background in strategy, agriculture and public-private partnerships. She has more than a decade of experience with GIZ, UNECE, the OECD, IFAD and Cambridge University CISL on global development issues and impact, a Masters in Public Policy from Sciences Po and Hertie School of Governance and post graduate qualifications from Cambridge University and INSEAD.

Specialist knowledge at the CFC

A range of in-house expertise at the CFC will provide ACT with a wide network of specialists in cross-commodity issues including climate finance, carbon markets and supply chain management as well as broader management support. They include:

• Nicolaus Cromme – Chief Operating Officer. Nicolaus has 23 years of investment experience with KFW and the CFC, holds an MSc in Tropical Agriculture from Hohenheim University and an MBA from Salford, UK.

• Hector Besong – Risk manager. Hector has worked for the CFC for over 7 years. Before CFC, he spent nearly 11 years at Siemens Bank GmbH in various roles, including Risk Manager and Director of Project & Export Finance. Earlier, he was a Partner at FGI Financial Services. Hector holds an MBA from Drexel University.

• Eva M. Johansson – TA Manager. Eva has wide experience of managing complex programmes for USAID and Sida and has a MSc in International Development from the University of Amsterdam.

• Peter Nielsen – Carbon specialist and Impact Investment Manager. Peter has a strong track record in agribusiness, a BSc in economics from SOAS and a MPhil from Cambridge University.

• Tia Sudjarwo – Treasury Assistant. Tia has 25 years of treasury experience, is an ACAMS certified associate in KYC/CDD and holds an accountancy degree from Atmajaya University, Jakarta.

• Michele Schwarz – Head of Accounting & Administration. Michele has an MBA from Heriot Watt University, a BSc in Business Administration and is an anti-money laundering specialist.

SDG - aligned impact is central to ACT

ACT aims to meet criteria under article 9 of the Sustainable Finance Disclosure Regulation (SFDR), prioritising impact while securing a financial return on investments. ACT targets investments that contribute to the United Nations’ Sustainable Development Goal (SDG) 1 No poverty, SDG 5 Gender equality, SDG 8 Decent work and economic growth, SDG 10 Reduce inequality within and among countries, SDG 12 Responsible consumption and production, and SDG 13 Climate action.

Sustainability risks management

The CFC’s social and environmental risk management system (SEMS) was co-designed with the International Labour Organisation. ACT will use SEMS to identify social and environmental risks associated with an investment prior to a transaction and during the lifetime of the investment.

Impact assessment

Impact measurement will be appraised by an expert third party at the beginning and end of each investment, with a bespoke approach for investee companies, financial institutions, traders and processors. In addition, investee companies will report their impact on an annual basis to identify areas for impact growth during the investment period and to continually mitigate risks.

The fund in numbers

ACT will drive profitability, enhance incomes and strengthen resilience in times of global market volatility. It will also drive the transition to climate-resilient smallholder agriculture and focus on providing liquidity to high potential agricultural SMEs, a lack of which is the single biggest barrier to growth.

Photo: Shalem plant - Shalem

After several years of negotiations, the African Continental Free Trade Area (AfCFTA) opened for business in 2021. Once fully implemented, the AfCFTA will be the world’s largest free-trade area, connecting 1.3 billion consumers across 54 countries in a single market for goods and services.

This has the potential to drive export diversification among African countries, which is one of our key goals at the CFC. Diverse economies are more resilient, which creates the stability businesses in the agricultural sector need to thrive. This is particularly important in Africa, where more than 80% of countries are classed as commodity dependent, which means most of their export earnings come from raw commodities, leaving them vulnerable to economic and environmental shocks.

Our investments are designed to enable agribusinesses to broaden their activities and add value to raw commodities, improving the incomes of their smallholder suppliers and diversifying the wider economy. In turn, this strengthens their ability to cope with the consequences of unexpected events such as the pandemic and the Ukraine war. We’re excited by the potential of AfCFTA to amplify the impact of our investments and accelerate export diversification. Here are five ways we believe it will have a positive impact on the communities and countries we operate in.

Building resilience to shocks

An overreliance on a single commodity isn’t good for a smallholder farmer working a hectare or two of land or for a national economy. An economic shock that leads to price volatility or an environmental event that wipes out a particular crop, can have a devastating impact on commodity dependent countries and farmers. For smallholders this reduces their ability to pay for essentials such as food, energy, medication and school fees.

We invest in agribusinesses that help smallholders develop the skills to grow new crops and access new markets. In Tanzania, for example, Natural Extracts Industries (NEI) works with coffee and banana farmers, to intercrop higher value vanilla which NEI then exports as vanilla extract. By diversifying, smallholders increase their incomes and create new revenue streams which builds resilient businesses and a stronger economy. Read more about NEI on page 87.

Increasing economic opportunity

According to the World Economic Forum, 60% of Africa’s population is under 25. By 2025 the continent is expected to account for 42% of the world’s young people. This creates challenges, but there is also an opportunity to build a dynamic economy around this demographic. One of the keys to achieving this is developing employment opportunities that encourage young people to remain in their communities and generate prosperity.

Diversification across all sectors is needed to make this happen and commodities can play their part. For example, in Senegal, where the average age is 22, rice processing company CNT which we supported with USD1.46m in financing, is investing in irrigation that turns unviable land into productive paddy fields. This enables more people to build careers locally, expands the domestic rice industry and reduces the country’s reliance on rice imports.

Encouraging entrepreneurship

Progressing from farming and exporting raw commodities, to manufacturing higher value products from those commodities, generates and retains greater wealth locally. It is progress our investment is designed to unlock, giving entrepreneurs the financing, they need to create new products that drive economic growth.

In Kenya our funding helped a grain aggregator, Shalem, transform into an added value manufacturer. The company built a processing factory, which expanded its capacity to deliver the value-added products that now account for 70% of its revenue, such as its fortified Asili Plus flour. This has created a year-round market for its smallholder suppliers alongside providing essential nutrients to consumers.

Attracting foreign investment

A diversified economy is more attractive to investors. Economies that feature a wide range of businesses selling into international markets tend to offer greater stability and are viewed positively. By adding value to their natural resources and diversifying exports, African countries can become more compelling investment propositions, particularly as trade barriers reduce across the continent.

Alongside this there is an increasing interest among international investors in businesses and funds that address environment, social and governance (ESG) issues. But few have the expertise in sustainable and equitable smallholder supply chains to confidently enter these markets. We launched our ACT Fund to overcome this challenge, by enabling private sector organisations to lean on our expertise in identifying and supporting agribusinesses capable of delivering genuine impact and reliable returns. Read more about ACT Fund on page 19.

Our Technical Assistance Facility also provides expert knowledge and advice to impact-investment funds keen to maximise the impact of their financing. In Africa it works with the Africa Agriculture and Trade Investment Fund (AATIF), which aims to drive inclusive and sustainable growth in agricultural supply chains on the continent.

Taking advantage of tech innovation

Technology can both extend the rewards of diversification to remote smallholder farmers and verify the sustainable credentials of supply chains for food brands, which regulators and customers increasingly demand.

We work with agribusinesses that use tech innovation to embed traceability into their supply chains and ensure farmers are paid fairly by, for example, making direct mobile payments to them. We have also invested in Meridia, a geospatial data company that provides farm mapping and field data collection and verification services, giving smallholders an accurate oversight of their businesses and food companies the transparency they need.

As agribusinesses seek to connect smallholders to more lucrative international markets, this level of oversight is becoming nonnegotiable. Read more about our work with Meridia on page 91.

In the coming years, as Africa breaks down barriers to trade through AfCFTA and innovation accelerates, opportunities to create a diverse economy are emerging. We want to help countries grasp them, and unlock prosperity for the poorest smallholders, by realising the full potential of the raw materials they grow.

© 2023 - Common Fund for Commodities