Annual Report 2024 V

Photo: Millet. Butaleja District, Uganda. © FAO/Stuart Tibaweswa

As an impact investor, the CFC is committed to financing investments that generate positive social, economic and environmental impacts across the developing world. To credibly and effectively uphold this commitment, the CFC recognises the need for a robust and efficient system for impact measurement and management (IMM).

To this end, the CFC’s Executive Board approved a new impact strategy in October 2018. This chapter describes how the CFC’s impact strategy has been operationalized to bring about measurable impacts in 2024. IMM remains an area of rapid development in the international development community and the CFC seeks to adopt the best emerging practices. In this edition of the CFC’s impact report we take particular note of the recommendations by Impact Frontier’s: Impact Performance Reporting Norms1 to report and present the CFC’s Impact Management Approach and Portfolio Impact Performance. For impact stories from the CFC’s portfolio please see Section II.

V.1 CFC’s Impact Thesis

Commodities are the foundation of both global progress and daily life, forming the backbone of industries, economies, and essential goods. From the food we eat to the materials that build our homes, commodities shape the world around us. Yet, while end users often take their availability for granted, the reality is far more complex. In many commodity-dependent countries, smallholder farmers rely on these very commodities for their survival. Unlike large-scale producers, smallholder farmers face unstable prices, limited market access, and vulnerability to climate change, leaving them trapped in cycles of extreme poverty.

As highlighted in the UN Trade and Development Report 20242, economic cycles and commodity prices in the commodity-dependent nations are closely linked with global financial market volatility, often amplifying economic instability. The expansion and financialization of extractive industries further complicates this landscape, posing a significant challenge for commodity-exporting countries, especially as they navigate the energy transition and a shifting global growth wave.

To break cycles of extreme poverty and build resilient economies, ensuring fair and sustainable commodity supply chains is more important than ever. In this pursuit, the CFC serves as a catalyst for positive change by providing financing for agricultural SMEs that connect primary commodity producers to higher value markets; in doing so, it helps smoothen smallholder incomes and reduce their dependence on financial cycles. By targeting specific commodity value chains, we ensure that the economic benefits of global markets reach those farmers that are most vulnerable. It is therefore our mission to contribute to poverty alleviation by strengthening the income-generating capacity of commodity producers and mitigating risks to their economic well-being.

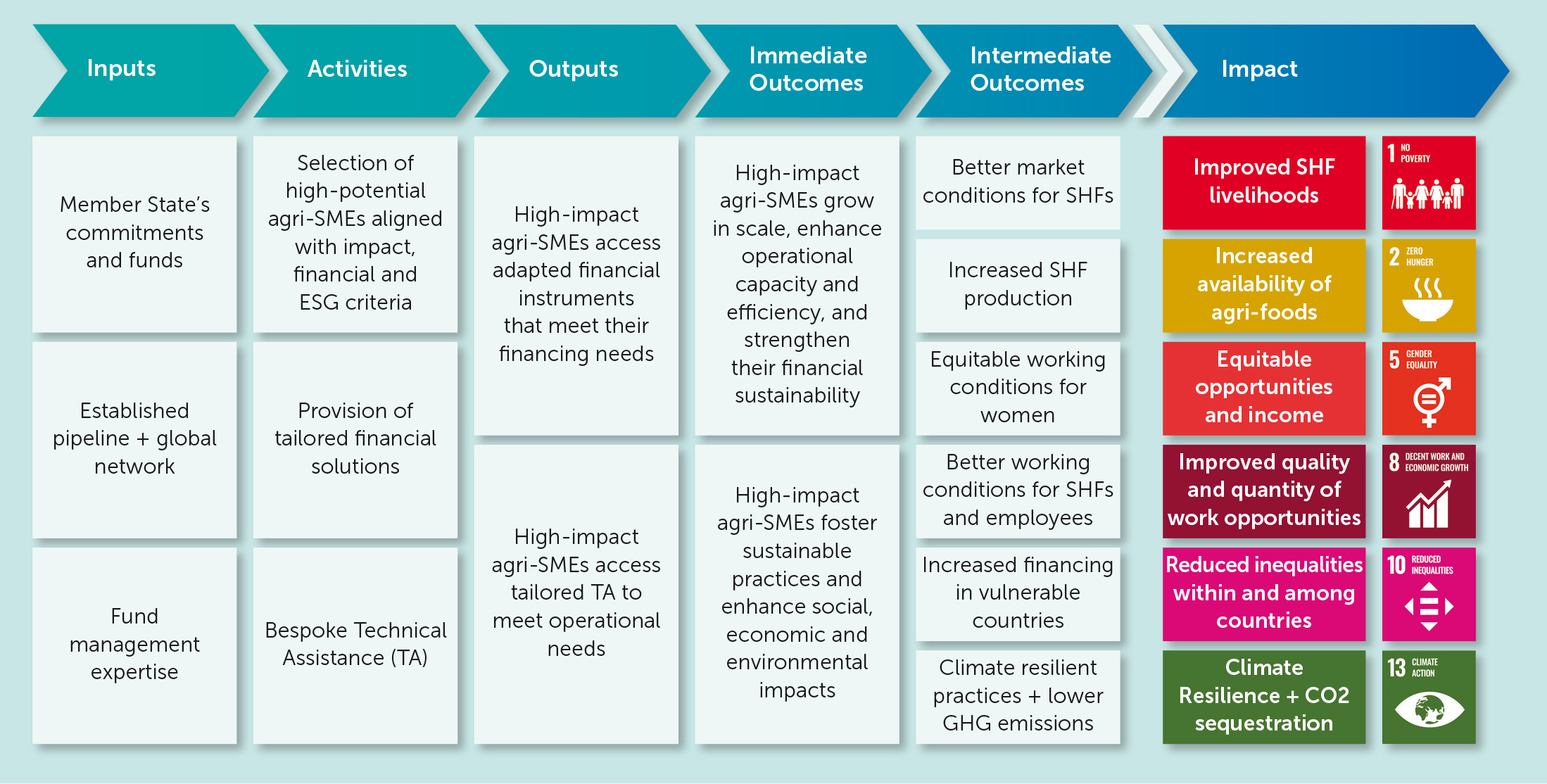

With this mission in mind, we have developed a simplified and comprehensive version of our Theory of Change (ToC). Our ToC acts as a roadmap, detailing the connections between the CFC’s activities, outputs, outcomes, and impacts, leading to well-defined impact goals connected to our core SDGs.

Guided by our ToC, we translate the CFC’s mission into action by taking a strategic, impact-oriented investment approach that targets value chains with the potential to uplift impoverished communities, especially those in Least Developed Countries (LDCs), Landlocked Developing Countries (LLDCs), and Small Island Developing States (SIDS). Our investments do not only support livelihoods but also enhance local value creation, strengthen economic resilience, and drive sustainable growth across commodity-dependent member states. By doing so, we foster long-term, meaningful improvements that extend beyond individual farmers to benefit entire communities.

V.2 CFC’s Impact Management Approach

At the CFC, we have dedicated significant time and effort to refining our approach to effective impact monitoring, environmental and social (E&S) risk assessment, and stakeholder communication. As pioneers in agricultural impact investing, we recognized early on the need for specialized impact monitoring systems and ESG tools. In the absence of comprehensive industry-wide frameworks, we developed our own methodologies, drawing from multiple sources to establish a robust system for measuring and managing impact. We also give due consideration to the needs and limitations of SMEs, being the main target group for CFC financing, in terms of their limited capacity to implement sophisticated IMM models.

Over time, as global frameworks evolve, we continuously refine our processes, integrating emerging best practices and new tools to enhance our effectiveness. Staying true to our mission, we have consistently applied lessons learned – both from our own experience and from leading actors in the field – to strengthen our capacity, improve risk mitigation strategies, refine impact indicators, and enhance data interpretation.

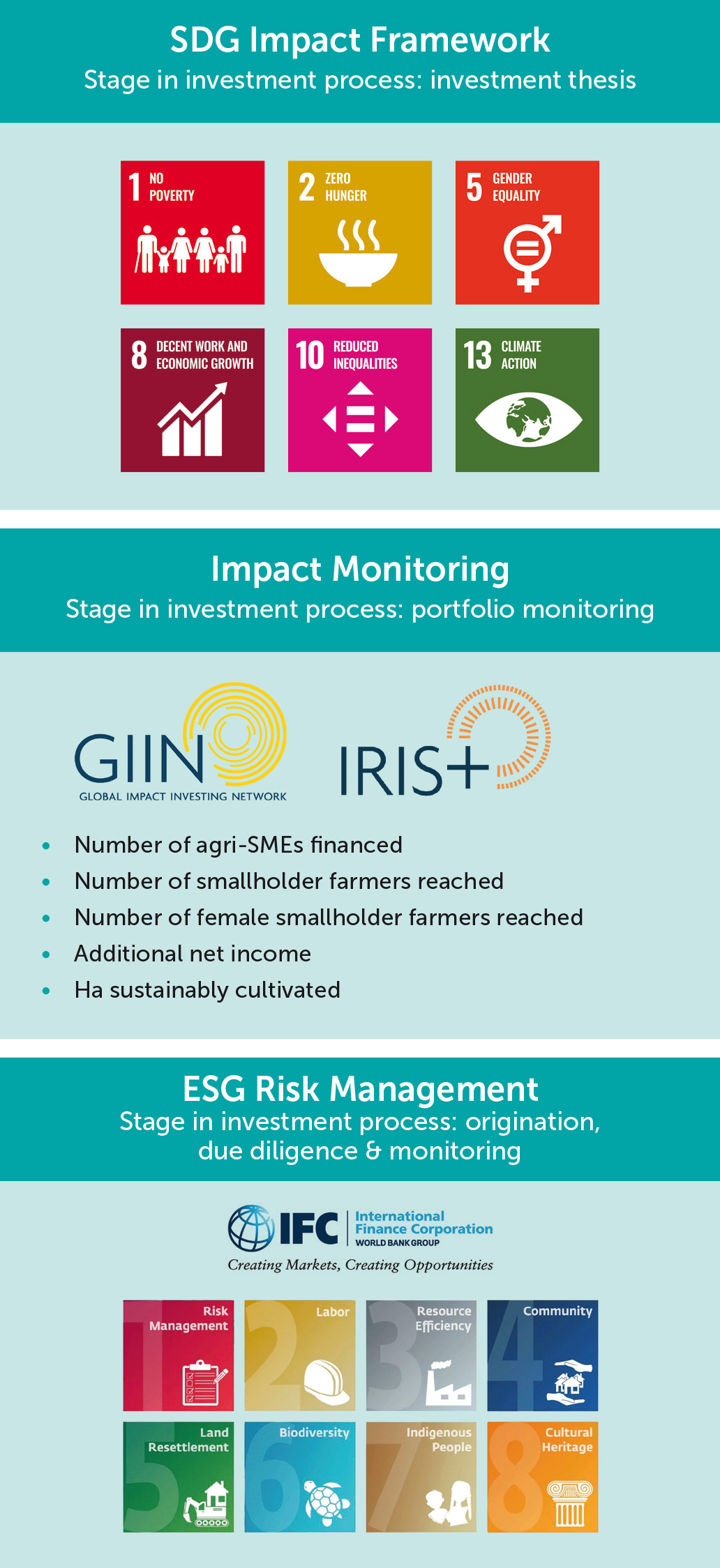

Our impact management approach is structured around three interconnected pillars that guide our impact efforts:

- The first pillar is our SDG Impact Framework, which serves as the foundation of our impact monitoring; aligning our investment strategy with our core Sustainable Development Goals (SDGs). This foundation ensures that our investments contribute meaningfully to globally recognized development objectives, reinforcing our commitment and accountability to sustainable development.

- The second pillar, Impact Monitoring, integrates insights from the Global Impact Investing Network’s (GIIN) IRIS+ Taxonomy to create a robust Impact Monitoring System. By integrating industry-leading indicators, we are able to comprehensively assess social, economic, and environmental impacts across our core SDGs, ensuring that our investments drive measurable and meaningful change.

- The third pillar, ESG Risk Management, focuses on a rigorous due diligence process and advanced risk rating tools aligned with the IFC Performance Standards. This framework enables us to systematically identify, evaluate, and mitigate potential risks across our portfolio, ensuring that our investments uphold the highest environmental, social, and governance standards while maintaining financial returns.

Together, these pillars create a structured yet adaptable system that ensures that our impact monitoring and risk management systems remain both consistent and responsive to new developments in the field. This adaptability allows the CFC to effectively support portfolio companies while incorporating the latest advancements in impact investing.

SDG Impact Framework

Driven by a commitment to make social, environmental and economic change, we at the CFC recognise the importance of assessing and reporting on the actual impacts of our agricultural investments. Measuring impacts ensures that CFC resources are effectively improving livelihoods, strengthening local economies, and fostering inclusive growth. With this purpose in mind, the CFC implements the Sustainable Development Goals (SDGs) as the impact framework through which we monitor and measure portfolio-wide impacts.

The SDGs represent a global call to action aimed at eradicating poverty, safeguarding the planet, and ensuring prosperity for all. These goals integrate economic, social, and environmental aspects of sustainable development, addressing the root causes of poverty and promoting global growth. Acknowledging the cross-cutting economic role of commodities, CFC-financed projects are positioned to drive progress across all 17 SDGs. However, the CFC’s impact management strategy focuses on making direct and measurable contributions to six selected core SDGs, prioritizing areas where commodities can have the most significant and tangible impacts. These include: SDG 1 (No Poverty), SDG 2 (Zero Hunger), SDG 5 (Gender Equality), SDG 8 (Decent Work and Economic Growth), SDG 10 (Reduced Inequalities), and SDG 13 (Climate Action).

It is important to note that the selection of these priority SDGs does not exclude others. Commodity issues are interconnected with all SDGs. For instance, CFC financing is often used to promote regenerative agricultural practices, such as pesticide replacement and sustainable irrigation, inherently impacting non-core SDG 6, Clean Water and Sanitation. Similarly, gender equality is a key consideration in every commodity project, with a gender lens applied throughout the CFC’s investment analysis and lifecycle. The SDGs serve as a universally recognized development framework, which we translate into action by prioritizing specific SDG targets, with progress measured through the use of IRIS+ indicators, as explained in the upcoming Impact Monitoring Section. Below, we present our impact rationale for each one of our core SDGs.

CFC's six core Sustainable Development Goals (SDGs)

The United Nation’s 2030 Agenda recognizes that eradicating poverty in all its forms, including extreme poverty, is one of the greatest current global challenge and a fundamental requirement for sustainable development. However, the COVID-19 pandemic and subsequent economic shocks from 2020 to 2022 severely disrupted global efforts to combat poverty. In 2020, the global extreme poverty rate rose for the first time in decades, erasing three years of progress.3 The UNCTAD Commodities and Development Report 20234 further highlights the urgency of addressing poverty, particularly in commodity-dependent developing countries (CDDCs), where economic vulnerability and inequality remain significant challenges. One of the most pressing challenges facing CDDCs is the economic instability driven by commodity price volatility– which perpetuates poverty and inequality– compounded by the global shift toward decarbonization, which threatens their economies as demand for traditional commodities declines. Addressing these issues is central to the CFC’s mission, which focuses on fostering economic resilience and poverty alleviation for commodity producers.

To help mitigate these challenges, the CFC plays an important role in stabilizing smallholder incomes by financing SMEs that work directly with farmers, ensuring fair farm gate prices, fair wages and a more predictable revenue stream. Additionally, the CFC supports economic diversification by funding underserved commodity sectors in vulnerable regions, fostering resilience and creating new opportunities for sustainable growth. Through these efforts, the CFC directly contributes to SDG 1 by strengthening local economies, reducing rural poverty, and supporting the long-term stability of CDDCs. While the CFC contributes to all targets under SDG 1, our strongest impact is observed in the following specific targets:

|

SDG Target |

Description |

|

Target 1.1 |

By 2030, eradicate extreme poverty for all people everywhere, currently measured as people living on less than USD 1.25 a day |

|

Target 1.2 |

By 2030, reduce at least by half the proportion of men, women and children of all ages living in poverty in all its dimensions according to national definitions |

|

Target 1.4 |

By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to basic services, ownership and control over land and other forms of property, inheritance, natural resources, appropriate new technology and financial services, including microfinance |

|

Target 1.5 |

By 2030, build the resilience of the poor and those in vulnerable situations and reduce their exposure and vulnerability to climate-related extreme events and other economic, social and environmental shocks and disasters |

Smallholder commodity producers are the backbone of agricultural and food production systems, playing a vital role in enhancing resilience and reducing hunger. Yet, despite their contributions, they remain among the most vulnerable groups, particularly across rural areas where households depend on small-scale farming for both sustenance and income. This vulnerability is reflected in global food insecurity trends. According to the 2024 Sustainable Development Goals Report5, as of 2023, 733 million people faced hunger, while 2.33 billion experienced moderate to severe food insecurity. Although progress has been made, 148 million children under five suffered from stunting in 2022, and if current trends continue, one in five children under five will be affected by stunting by 2030.

Access to credit is a critical driver of agricultural productivity and sustainability, enabling smallholder farmers and SMEs to invest in better practices, purchase essential inputs like seeds and fertilizers, and adopt innovative technologies. By providing loans and financial instruments, the CFC helps bridge funding gaps in developing countries, fostering more resilient food systems. Alongside financial support, the CFC offers technical assistance, equipping farmers and enterprises with knowledge on modern farming techniques, sustainable practices, pest management, and efficient water use. These skills enhance crop yields, quality, and marketability, while also helping farmers meet international standards, opening new markets and increasing their food supplies.

The CFC is committed to a world where everyone has access to safe, nutritious, and sufficient food. By investing in SMEs that support smallholder farmers, the CFC helps increase productivity and strengthen resilience to external risks. By focusing on improving access to credit and technical assistance, the CFC enhances SME’s capacity to purchase from, or provide for, smallholders in food-insecure regions. In doing so, we directly contribute to enhancing food supplies and improving livelihoods where they are needed most. In the upcoming Impact Monitoring Section, we present the Impact Monitoring System used to monitor and measure impacts related to SDG 2.

While the CFC contributes to all targets under SDG 2, our strongest impact is observed in the following specific targets:

|

SDG Target |

Description |

|

Target 2.3 |

By 2030, double the agricultural productivity and incomes of small-scale food producers, in particular women, indigenous peoples, family farmers, pastoralists and fishers, including through secure and equal access to land, other productive resources and inputs, knowledge, financial services, markets and opportunities for value addition and non-farm employment |

|

Target 2.4 |

By 2030, ensure sustainable food production systems and implement resilient agricultural practices that increase productivity and production, that help maintain ecosystems, that strengthen capacity for adaptation to climate change, extreme weather, drought, flooding and other disasters and that progressively improve land and soil quality |

|

Target 2.a |

Increase investment, including through enhanced international cooperation, in rural infrastructure, agricultural research and extension services, technology development and plant and livestock gene banks in order to enhance agricultural productive capacity in developing countries, in particular least developed countries |

The world remains far from achieving gender equality by 2030. Women continue to be underrepresented in public life and leadership, and at current rates, achieving parity in management positions would take 176 years.6 The situation is particularly critical in rural areas, where women constitute an average of 38.5% of the agricultural workforce; a figure that rises above 50% in 25 developing countries, most of which are in the African continent.7 Despite their vital role in agriculture, women continue to face severe disparities in access to land, finance, technology, and fair income.8 These systemic inequalities contribute to economic dependency and limit productivity in commodity-dependent areas. Addressing this disparity requires urgent and targeted action to challenge gender-biased norms, eliminate harmful practices, and repeal discriminatory laws that obstruct women’s full participation and empowerment in the agricultural sector.

Recognizing the cross-cutting and transformative potential of investing in women, the CFC is deeply committed to advancing gender equality by applying a gender lens to its investments, actively prioritizing women-led enterprises, employment opportunities for women, and greater female representation in leadership. To safeguard against gender-based risks, the CFC integrates gender considerations into due diligence, whilst also tracking progress and ensuring positive impacts on women using key 2X Challenge-aligned indicators, such as female leadership, employment, and ownership. This approach helps us identify and support SMEs that either already demonstrate gender balance and inclusive policies or show strong potential to do so; particularly those with the capacity to create meaningful impact for women smallholders.

While the CFC contributes to all targets under SDG 5, our strongest impact is observed in the followings pecific targets:

|

SDG Target |

Description |

|

Target 5.5 |

Ensure women’s full and effective participation and equal opportunities for leadership at all levels of decision-making in political, economic and public life |

|

Target 5.a |

Undertake reforms to give women equal rights to economic resources, as well as access to ownership and control over land and other forms of property, financial services, inheritance and natural resources, in accordance with national laws |

Progress towards achieving SDG 8 faces the lingering effects of the COVID-19 pandemic, ongoing trade tensions, rising debt burdens in developing countries, and escalating geopolitical conflicts. These pressures disproportionately affect developing countries, particularly those with large rural populations engaged in informal and vulnerable employment. According to the International Labour Organization (ILO), over 90% of agricultural jobs worldwide are informal.9 This rural workforce often lacks job security, stable incomes, social protection, or avenues for social dialogue, highlighting the urgent need for structural transformation in rural labour markets.

The CFC recognizes the vital role that decent employment plays in fostering sustainable and inclusive development. Our investments are therefore designed to promote employment across key – often under-served – agricultural value chains. These value chains are labor-intensive and crucial to many developing economies, making them strategic levers for widespread employment generation. These investments play into SDG 8’s wider strategy of reducing overreliance on narrow sets of exports, stabilizing local economies, and protecting communities from external shocks.

The CFC prioritizes not just the quantity of jobs but their quality; we do this by financing SMEs that are committed to fair farmgate prices, decent wages, and safe working conditions that form the foundation of productive and dignified work. These are elements that we monitor by using a select group of IRIS+ indicators such as smallholder income, farmgate prices and number full-time and parttime employees. Our inclusive investment approach focuses on upgrading value chains where SMEs, smallholder farmers and women are central actors. By doing so, we support broader goals such as reducing inequality and empowering marginalized groups, thus reinforcing the interconnected aims of the SDGs.

While the CFC contributes to all targets under SDG 8, our strongest impact is observed in the followings pecific targets:

|

SDG Target |

Description |

|

Target 8.2 |

Achieve higher levels of economic productivity through diversification, technological upgrading and innovation, including through a focus on high-value added and labour-intensive sectors |

|

Target 8.4 |

Improve progressively, through 2030, global resource efficiency in consumption and production and endeavour to decouple economic growth from environmental degradation, in accordance with the 10-Year Framework of Programmes on Sustainable Consumption and Production, with developed countries taking the lead |

|

Target 8.7 |

Take immediate and effective measures to eradicate forced labour, end modern slavery and human trafficking and secure the prohibition and elimination of the worst forms of child labour, including recruitment and use of child soldiers, and by 2025 end child labour in all its forms |

|

Target 8.8 |

Protect labour rights and promote safe and secure working environments for all workers, including migrant workers, in particular women migrants, and those in precarious employment |

Progress toward reducing global inequality is facing a critical setback. Currently, half of the world’s most vulnerable nations are experiencing slower economic growth than wealthier countries. According to the 2024 Sustainable Development Goals Report, 90% of people suffering from hunger and malnutrition live in these vulnerable countries, half of which are already in debt distress or face a high risk of it.

To combat this inequality, the CFC supports investments across the world’s most vulnerable regions, including numerous Least Developed Countries (LDCs). We finance projects in LDCs that have the potential to impact those in extreme poverty, but would otherwise go unfinanced due to their country risk. Additionally, we specifically target interventions that clearly benefit identified vulnerable groups such as smallholder farmers, women and indigenous, tribal and ethnic communities. By focusing on these groups, we help to elevate the economic status of marginalised groups and promote equitable opportunities.

A key element of our strategy is supporting the ‘missing middle’: SMEs that are too large for microfinance yet too small or risky for traditional commercial lending. These enterprises play a vital role in local economies but frequently lack the financial resources needed to scale and reach broader markets. By providing catalytic funding, the CFC empowers SMEs and smallholder farmers to grow, improve their market access, and secure better prices for their goods. This not only boosts incomes but also strengthens their integration into the global economy, contributing to reduced economic disparities both within and across countries.

While the CFC contributes to all targets under SDG 10, our strongest impact is observed in the followings pecific targets:

|

SDG Target |

Description |

|

Target 10.1 |

By 2030, progressively achieve and sustain income growth of the bottom 40 per cent of the population at a rate higher than the national average |

|

Target 10.2 |

By 2030, empower and promote the social, economic and political inclusion of all, irrespective of age, sex, disability, race, ethnicity, origin, religion or economic or other status |

|

Target 10.6 |

Ensure enhanced representation and voice for developing countries in decision-making in global international economic and financial institutions in order to deliver more effective, credible, accountable and legitimate institutions |

|

Target 10.b |

Encourage official development assistance and financial flows, including foreign direct investment, to States where the need is greatest, in particular least developed countries, African countries, small island developing States and landlocked developing countries, in accordance with their national plans and programmes |

The global climate crisis continues to accelerate with rising global temperatures and climate risks. Climate change, driven primarily by human-induced greenhouse gas emissions, is causing rapid global warming that threatens ecosystems, biodiversity, food security, sea levels, and land stability, disproportionately impacting vulnerable regions and jeopardizing progress across multiple SDGs.10 Communities in commodity-dependent regions are suffering from extreme weather and increasingly frequent and more intense disasters, causing food insecurity and hindering livelihoods.

The CFC recognises that smallholder farmers are particularly vulnerable to climate change, as their livelihoods depend heavily on agriculture, and they often reside in regions prone to severe climate variability. At the same time, the CFC acknowledges that conventional agricultural practices can place considerable pressure on natural ecosystems and, in some cases, contribute to the acceleration of climate change. This dual awareness underscores the importance of promoting sustainable, climate-smart approaches that both safeguard smallholder livelihoods and reduce the environmental footprint of agricultural production.

We are therefore devoted to promoting sustainable agricultural practices that reduce environmental impact and greenhouse gas emissions while strengthening climate resilience. Recognizing the critical role of low-carbon technologies in commodity production, the CFC finances SMEs that implement and/or promote regenerative practices. These practices not only lower carbon footprints but also enhance soil health and generate tangible economic benefits for smallholders. Practices such as no-till farming, crop rotation, and agroforestry improve soil fertility, increase water retention, and boost yields, leading to more reliable incomes. At the same time, these practices help sequester carbon and buffer farms against climate-related shocks, such as droughts or floods. By enabling smallholders to integrate these proven techniques, CFC investments support a transition toward farming systems that are both economically viable and climate resilient.

In addition to financing, the CFC provides technical capacity building through training, workshops, and practical resources that promote climate-smart agriculture – such as drought-resistant crops, efficient irrigation systems, and sustainable land management. By offering both financial and technical support, the CFC empowers smallholder-linked SMEs to adopt sustainable practices that protect the environment and smallholder livelihoods.

While the CFC contributes to all targets under SDG 13, our strongest impact is observed in the followings pecific targets:

|

SDG Target |

Description |

|

Target 13.1 |

Strengthen resilience and adaptive capacity to climate-related hazards and natural disasters in all countries |

|

Target 13.b |

Promote mechanisms for raising capacity for effective climate change-related planning and management in least developed countries and small island developing States, including focusing on women, youth and local and marginalized communities |